Builders Risk Insurance in North Carolina

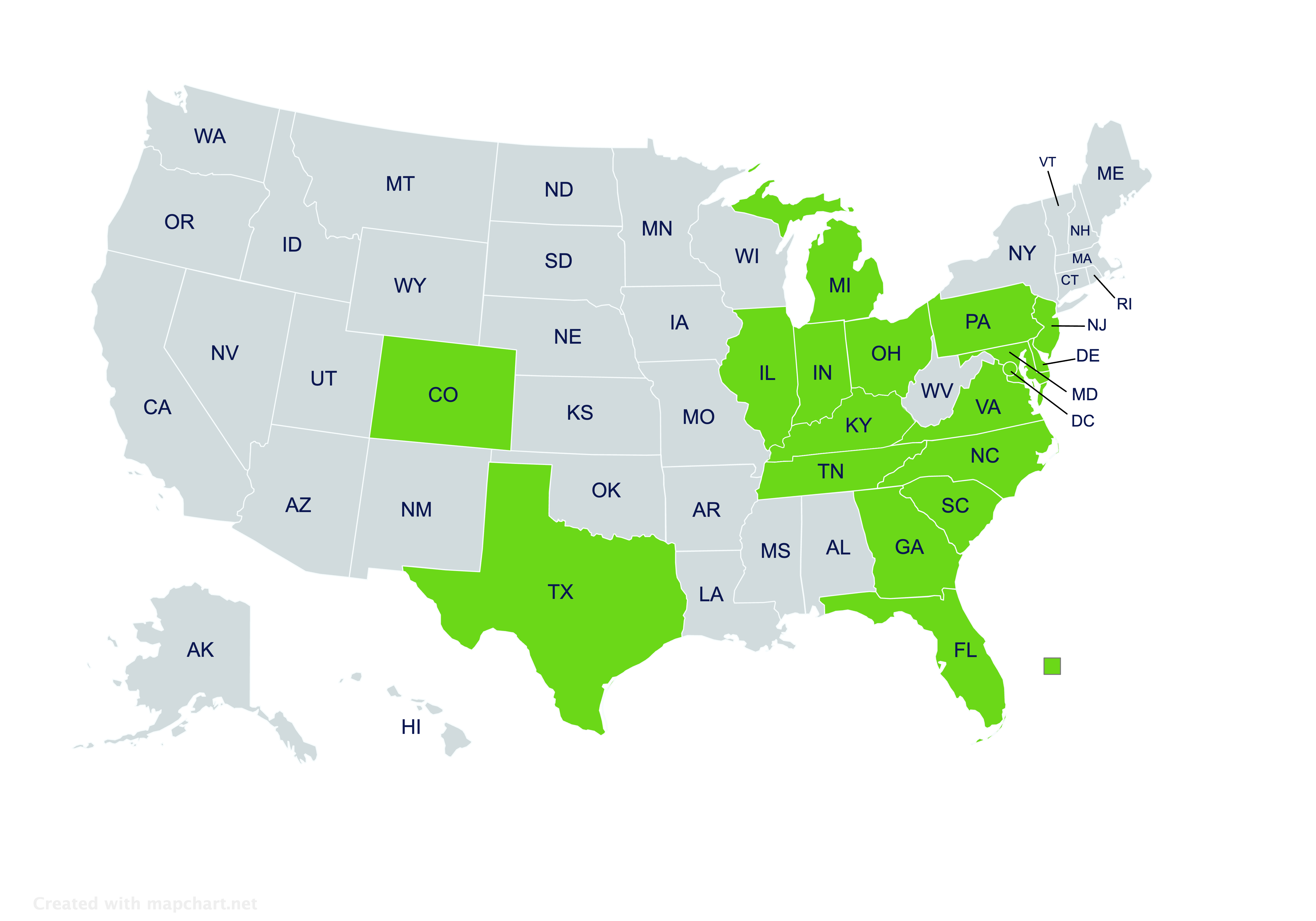

Providing builders risk insurance solutions to residents in North Carolina and beyond.

Get a Quote

Send us your information for a free quote!

Builders Risk Insurance in North Carolina

What is builders risk insurance?

Almost every major construction project could be delayed. While short delays might be mitigated by building buffers into timelines and working with customers, prolonged delays can leave contractors liable for expensive costs. Builders risk insurance might help construction companies in North Carolina protect themselves from such costs.

Builders risk insurance offers specialized coverage for large construction projects. Policies might cover delays in work, failure to complete work, and some other risks.

What types of construction projects do North Carolina contractors get builders risk coverage for?

Builders risk coverage is primarily used to protect North Carolina contractors working on larger construction projects. It’s commonly purchased for commercial construction, and similar construction.

For example, a contractor might get builders risk coverage when hired for the new construction of an office building, retail mall, manufacturing facility, research lab, warehouse, or multifamily housing property. Policies could also be used for municipal buildings, medical facilities, schools, public infrastructure, and similar projects.

In select cases, coverage may be procured for major renovation, remodeling, or capital improvement projects. Whether it should be used for work other than new construction depends on the scope of the remodel or improvement.

Can builders risk be used to insure the construction of a single-family house?

The construction of one single-family home usually isn’t a large enough project to necessitate builders risk. While developers building out a new residential development should certainly consider the coverage, it’s not typically purchased for just one house.

If coverage is wanted for a single house, perhaps for an especially large home, contractors can talk with a knowledgeable insurance agent. An agent who specializes in builders risk policies will be able to check what options might be available.

What items does builders risk cover at a construction site?

In addition to protecting against delays, many builders risk policies also cover certain items at a construction site. Depending on terms, a policy may extend coverage to:

- Heavy equipment and common tools

- Specialized equipment and tools

- Construction supplies and materials

- Structures that have been completed

- Structures that are still being worked on

Coverage for any of these can vary, but it’s especially common for policies to cover structures differently. A policy could cover no structures, only structures that aren’t yet completed, only structures that are completed, or all structures being worked on. A knowledgeable agent can check what structures a particular builders risk policy would cover.

What perils does builders risk cover?

The exact perils that a builders risk policy covers can also vary, but most protect against a range of things that could happen. Risks such as smoke, fire, severe weather, vandalism, and theft are frequently covered.

Can contractors extend a builders risk policy if they have a delay in work?

Some builders risk policies may allow for an extension in the event of a delay. Not all policies have such an option, though, and those that do usually limit it to one extension. If a policy can’t be extended and there’s a delay, a new policy will likely have to be purchased.

How much does a builders risk policy cost?

The premiums charged for builders risk policies can vary, depending on the project’s size, expected timeline, and total cost. The equipment used, the contractor’s experience, and many other factors may also influence premiums.

To find out how much builders risk will cost for a particular project, construction companies can check quotes with an independent insurance agent. An independent agent will be able to request quotes for builders risk policies from several insurers.

Where can construction companies get builders risk insurance for projects in North Carolina?

If you need builders risk insurance for a construction project that’s located in North Carolina, get in touch with the independent insurance agents at Pegram Insurance. Our team has worked with many contractors in the state, and we have the expertise to make sure your project is protected well.

Working hours

Open | Mon-Fri 9am – 5pm

Closed | Sat-Sun & Holidays

Office

Social profiles

Get in touch!

For questions or insurance quotes, contact us today!