Brewery Insurance in North Carolina

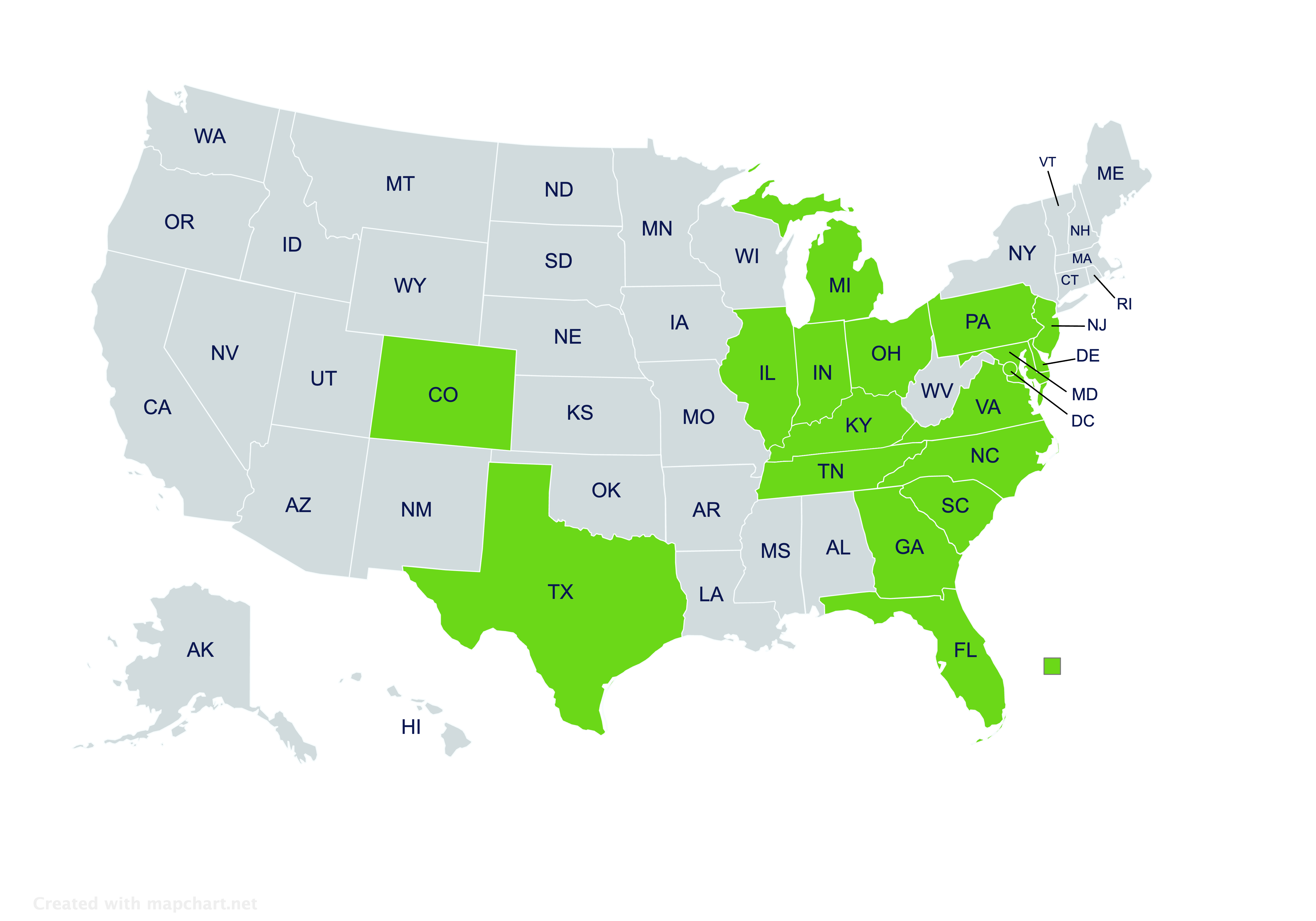

Providing brewery insurance solutions to residents in North Carolina and beyond.

Get a Quote

Send us your information for a free quote!

Brewery Insurance in North Carolina

What is brewery insurance?

Running a brewery requires a substantial investment and comes with certain significant risks. Brewery insurance may help breweries in North Carolina shield themselves from many of the risks they face, thereby protecting the business and investment.

Brewery insurance offers tailored commercial insurance coverage for breweries. Policies may come with both liability and property coverages that can be customized.

Which businesses in North Carolina need microbrewery insurance?

Microbrewery insurance is broadly recommended for most small to medium-sized breweries in North Carolina. This tends to be the best insurance option for breweries, and not insuring could be costly.

Other businesses that make alcoholic beverages might need many similar coverages. There are other insurance options for distilleries, wineries, and others in the adult beverage industry.

What protections can microbrewery insurance include?

Microbrewery policies can come with a variety of important protections, including both liability protections and property protections.

Liability coverages normally insure against situations where a brewery could be held financially responsible for injury or property damage that another party suffers. Some examples of liability protections that these policies might offer are:

- General Liability Coverage: May insure against common slip-and-fall accidents occurring on a brewery’s premises. Usually also covers slander, libel, and false advertising suits.

- Product Recall Coverage: May insure against the recall of beer that’s been sold but poses a risk to customers’ health.

- Commercial Auto Coverage: May insure against accidents involving delivery trucks or other vehicles that a brewery owns. Usually also covers other causes of vehicle damage.

- Commercial Umbrella Coverage: May add extra protection, in case an expensive lawsuit exceeds another liability coverage’s limit.

Property coverage normally protects assets that a brewery owns, typically offering compensation if something is destroyed or damaged in a covered incident. Some property protections that policies typically offer are:

- Business Property Coverage: Might cover buildings, brewing equipment, and supplies, along with furniture, computers, and other items.

- Tank Collapse Coverage: Might cover water processing costs in the event of a tank collapse.

- Tank Leakage Coverage: Might cover the loss of beer stock in the event of a tank leak or collapse.

- Product Adulteration/Contamination Coverage: Might cover beer stock that becomes contaminated during the brewing process.

- Business Interruption Coverage: Might cover revenue losses following major natural disasters.

An insurance agent who specializes in microbrewery insurance can review these protections in more detail, and go over any other protections that are available.

Do breweries need to have workers compensation coverage?

Workers compensation can provide important protections against workplace injuries. If an employee is injured while working, the coverage will normally reimburse medical costs and some lost wages.

North Carolina state law generally requires that businesses with three or more employees carry workers comp. Thus, most breweries should be prepared to get it.

An insurance agent who’s familiar with craft brewery insurance can help set up workers compensation coverage.

How much does craft brewery insurance cost?

The cost of craft brewery insurance varies, as premiums are based on many different factors. A brewery’s facility size, annual sales, equipment used, and past claims history are just a few of the details that insurance companies consider when setting premiums.

Craft breweries can find out how much their insurance will cost by comparing policies with an independent agent. An independent agent isn’t obligated to promote any one insurance company, but can request and show quotes from several companies that offer craft brewery insurance.

How can breweries in North Carolina get brewery insurance?

If you have a brewery that needs insurance, get in touch with the independent insurance agents at Pegram Insurance. Our North Carolina agents will work closely with you to determine risk exposures and coverage needs. We’ll then make sure you find a brewery insurance policy that meets your brewery’s particular needs, offering you robust protection.

Working hours

Mon-Fri 9 am -12 pm and 1 pm – 5 pm

By Appointment Only: 12 pm – 1 pm

Office

Social profiles

Get in touch!

For questions or insurance quotes, contact us today!