Vacant Land Insurance in North Carolina

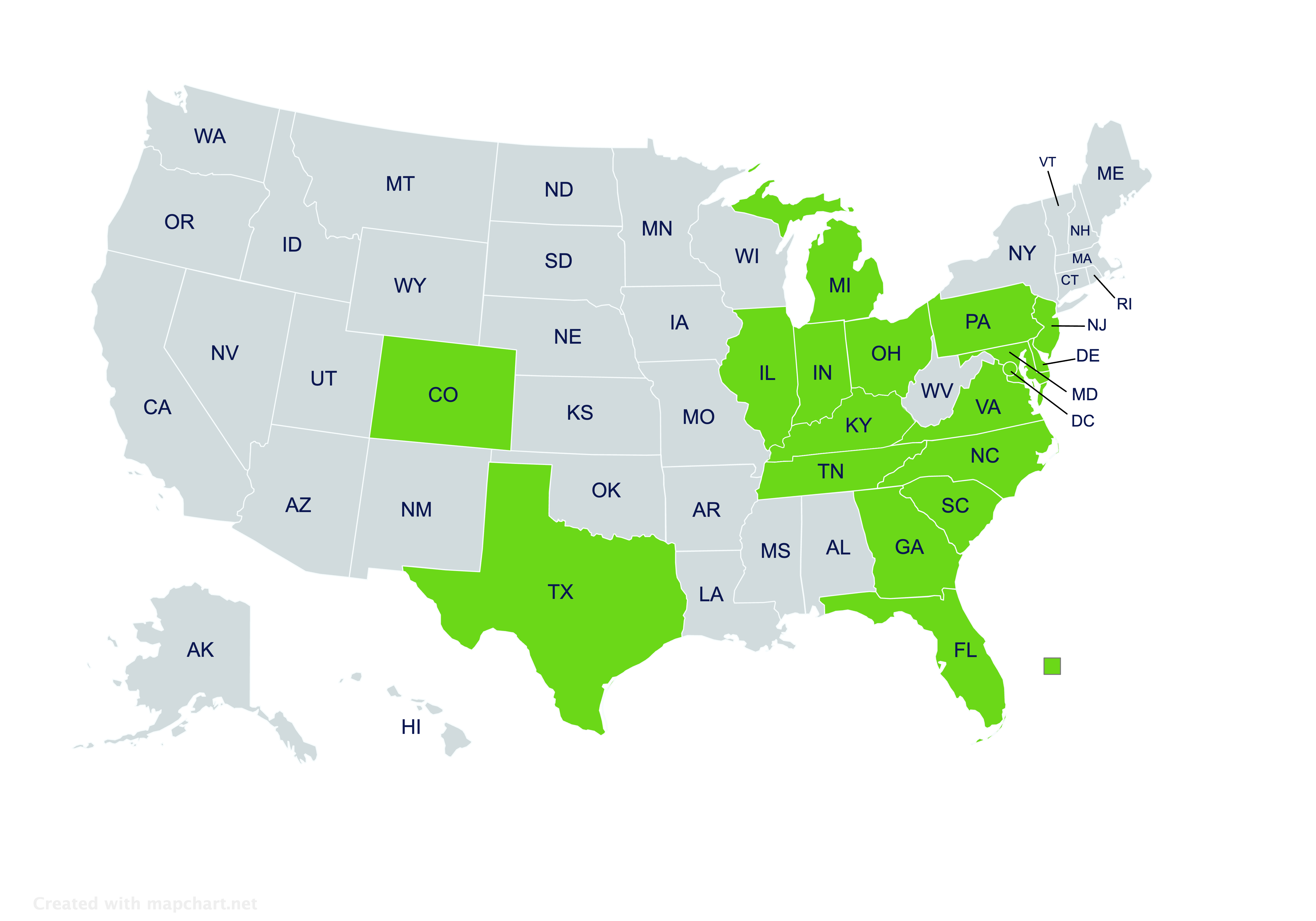

Providing vacant land insurance solutions to residents in North Carolina and beyond.

Get a Quote

Send us your information for a free quote!

Vacant Land Insurance in North Carolina

What is vacant land insurance?

Purchasing vacant land isn’t without some potential risks that ought to be insured against. While undeveloped land usually doesn’t need the property protections that buildings and other structures do, it’s usually still recommended that landowners insure against liability risks. That’s what vacant land insurance can help landowners in North Carolina do.

Vacant land insurance provides specialized coverage for undeveloped properties. Policies primarily focus on giving landowners liability protection against various potential risks.

Who needs vacant land liability insurance?

Vacant land liability insurance is recommended for most undeveloped properties in North Carolina. This is especially true if the risk of injury is high, but any property might be insured.

People can be seriously hurt on properties with waterfront, bluffs, or other more dangerous terrain. They can also be injured on more mundane terrain too, though.

What types of property need vacant land liability insurance?

Vacant land policies are available for almost all types of undeveloped land, ranging from waterfronts to urban lots. The following are some examples of who might purchase this type of insurance for a property:

- Homeowner has a lot on which they’ll build their dream home in the future

- Investor has multiple acres that they’ll develop or sell in the future

- Real estate developer has a property that they haven’t begun construction on yet

- Individual has a remote lot that they use for camping, hunting, fishing, or hiking

- Non-state resident has a property in North Carolina that they frequently visit

What coverages do vacant land policies provide?

Vacant land policies mainly have liability coverage, which might cover costs if someone is injured or tragically dies on the insured property. Court fees, attorney fees, and a settlement or judgment may be paid if there’s a covered incident and lawsuit.

Do vacant land policies provide any property protections?

Vacant land policies are typically liability-only policies. They usually don’t come with property protections, which are mainly for protecting buildings or other assets against damage or loss.

If a property has buildings or other significant structures on it, then a property insurance policy might be needed instead of a vacant land policy.

Do vacant land policies cover outdoor sports like hunting and fishing?

Outdoor sports like hunting, fishing, and riding four-wheelers increase the chances of someone being injured on a property.

Some vacant land policies might cover these activities, either as a standard feature or an optional one. Other policies might not cover injuries sustained while participating in one of these outdoor sports.

If coverage for outdoor sports is needed, an insurance agent can help find a policy that’ll cover these activities.

What’s considered an attractive nuisance?

An attractive nuisance generally refers to anything on a property that could be both dangerous and interesting to children. Some potential examples include construction equipment, trampolines, abandoned vehicles, old sheds, and natural features like waterfront or cliffs.

Because attractive nuisances can increase the risk of a child being injured, they sometimes require special consideration when purchasing vacant land liability insurance. The insurance company might have to be notified, the property owner might have to take certain precautions, and a specific endorsement or optional protection might need to be added onto a policy.

Landowners who are insuring a property that has one or more attractive nuisances should compare coverage terms with an experienced agent. An agent who’s worked with vacant land policies before will be able to check the protections and requirements of a particular policy.

How can landowners with undeveloped properties get vacant land insurance?

If you need help insuring an undeveloped property that’s in North Carolina, contact the independent insurance agents at Pegram Insurance. Our agents will work closely with you, to find a vacant land insurance policy that provides robust liability protections for your property.

Working hours

Mon-Fri 9 am -12 pm and 1 pm – 5 pm

By Appointment Only: 12 pm – 1 pm

Office

Social profiles

Get in touch!

For questions or insurance quotes, contact us today!