Event Insurance in North Carolina

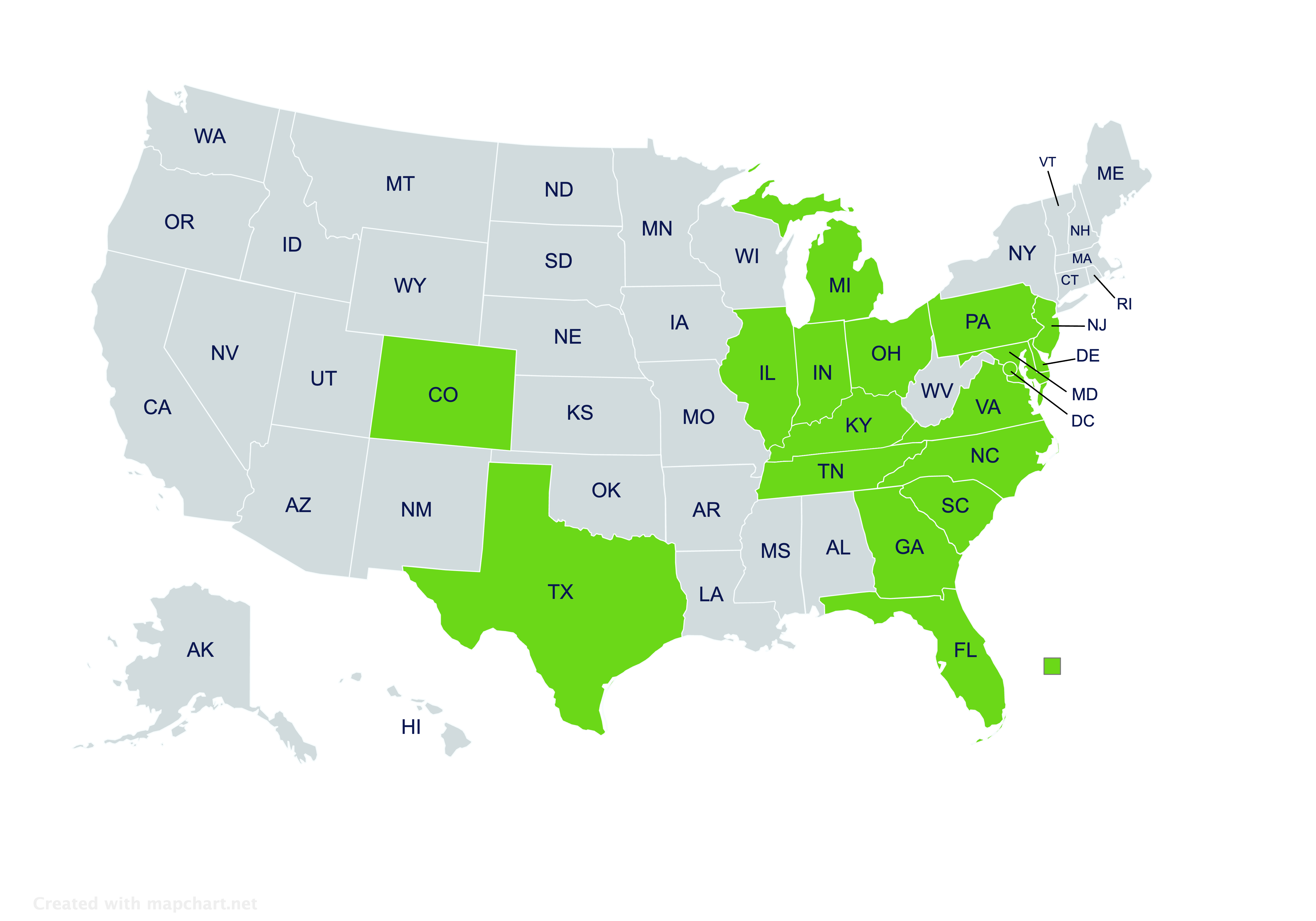

Providing event insurance solutions to residents in North Carolina and beyond.

Get a Quote

Send us your information for a free quote!

Event Insurance in North Carolina

What is event insurance?

Putting on an event of any significant size can come with some significant risks. Attendees could be injured on the premises, products given out could cause injury, spectators could be hurt during shows, and any number of other things can go wrong. Event insurance may give the sponsors of events in North Carolina protection against a range of potential risks.

Event insurance offers event sponsors and hosts specialized protections during their events. Policies usually come with multiple liability coverages for robust protection against accidents.

What North Carolina events should an event liability insurance be purchased for?

Event liability insurance is broadly recommended for events that North Carolina municipalities, businesses, and nonprofits put on. A policy may cover anything from a one-day party to a week-long fair.

In some cases, event policies are also recommended for large private gatherings. A routine birthday party where family and close friends attend normally doesn’t require an event policy. A policy may be helpful if holding a larger family reunion, wedding, anniversary celebration, graduation party, or similar gathering.

What protections can hosts get through event policies?

Event policies may give hosts and sponsors a variety of protections. Depending on the features of a policy, it might offer coverages such as the following:

- General Liability Coverage: May insure against basic accidents that occur during an event itself, or during setup and takedown. Falling down stairs, tripping over an extension cord, or similar accidents might be covered.

- Product Liability Coverage: May insure against injuries or property damage that’s caused by products distributed during an event. Covered products could include foods and beverages, game and contest prizes, sold merchandise, and free swag that’s given out.

- Spectator Liability Coverage: May insure against injuries sustained by attendees while they’re watching shows or competitions. Coverage might be needed for athletic competitions, live concerts, live animal shows, or other performances.

- Automobile Liability Coverage: May insure vehicles used at the event, which could include shuttles and buses, security cars and trucks, delivery vans, or other vehicles.

- Liquor Liability Coverage: May insure against accidents and other incidents that involve an intoxicated attendee. Covered incidents might include basic accidents, sexual assaults, physical altercations, and cases of alcohol poisoning.

- Medical Malpractice Coverage: May insure against mistakes made by medical personnel hired for the event, such as EMTs, paramedics, nurses, or doctors.

In addition to these fairly common liability protections, more specialized coverages might be needed for certain types of events. For example, animal liability coverage and aircraft liability coverage might be needed if animals or aircraft are used. An insurance agent who knows event liability policies well can help with finding these or other specialized coverages if they’re needed.

Can event policies cover fireworks shows?

Event policies usually don’t include coverage for fireworks shows as a standard feature, but it may be available as an option within some policies. This is one of the more specialized protections that a knowledgeable insurance agent can help with.

What’s an “additional insured” in an insurance policy?

An “additional insured” is normally a non-policyholder who can still make claims against the insurance policy. Other businesses might request to be listed as an additional insured on an event policy, so they have added protections.

For instance, a venue, major vendor, or sponsor might only agree to be involved with an event if they’re listed as an additional insured on the event organization’s insurance policy.

How much does insuring a one-day event cost?

One-day event insurance can often be had quite affordably. Insurance companies can typically keep premiums low since coverage only needs to be in effect for a single day.

To find out how much insuring a particular one-day event would cost, hosts can work with an independent insurance agent. An independent agent will be able to compare one-day event insurance quotes from several companies.

Where can event hosts in North Carolina get event insurance?

If you need help finding insurance for an event that’ll be held in North Carolina, contact the independent insurance agents at Pegram Insurance. Whether you need one day event insurance or event insurance for more than a week, we can help make sure your festivities are properly covered.

Working hours

Open | Mon-Fri 9am – 5pm

Closed | Sat-Sun & Holidays

Office

Social profiles

Get in touch!

For questions or insurance quotes, contact us today!