Workers Compensation Insurance Quotes for Charlotte, NC

Get a Quote

Send us your information for a free quote!

Workers compensation insurance coverage in NC and SC protects you against expenses arising from your employees getting injured on the job.

Coverage for employees under workers comp coverage extends beyond just their medical bills. They can be awarded lost income, death benefits, and rehabilitation expenses as well. This is an important way to protect yourself against claims made against you by your employees. In fact, there are state laws that require you to have this coverage in certain situations. In NC, most business with 3 or more employees are required to have workers comp coverage. The statutory limits in NC are 100/100/500 or $100,000 each employee, $100,000 each accident, $500,000 policy limit.

In addition to protecting yourself and meeting the legal requirements, you may find yourself in need of workers comp insurance to meet a contract requirement. A lot of contractors will ask for a certificate of insurance proving you have coverage in place in order to do work for them.

If you have encountered a contract requirement and you don’t have employees, you can obtain a workers compensation policy through the North Carolina Rate Bureau. This is commonly referred to as a ghost policy or an owner excluded policy.

We are thoroughly trained and qualified to issue workers comp policies of all kinds. If you are in need of a policy for a contract requirement, NC state laws, or just to protect yourself, please give us a call at (704) 494-9495 so we can show you how much money you can save and coverage we can provide.

Typical Workers Comp Coverage Choices

- 100/100/500- $100,000 Each Employee/$100,000 Each Accident/$500,000 Policy Limit

- 500/500/500- $500,000 Each Employee/$500,000 Each Accident/$500,000 Policy Limit

- 1M/1M/1M- $1,000,000 Each Employee/$1,000,000 Each Accident/$1,000,000 Policy Limit

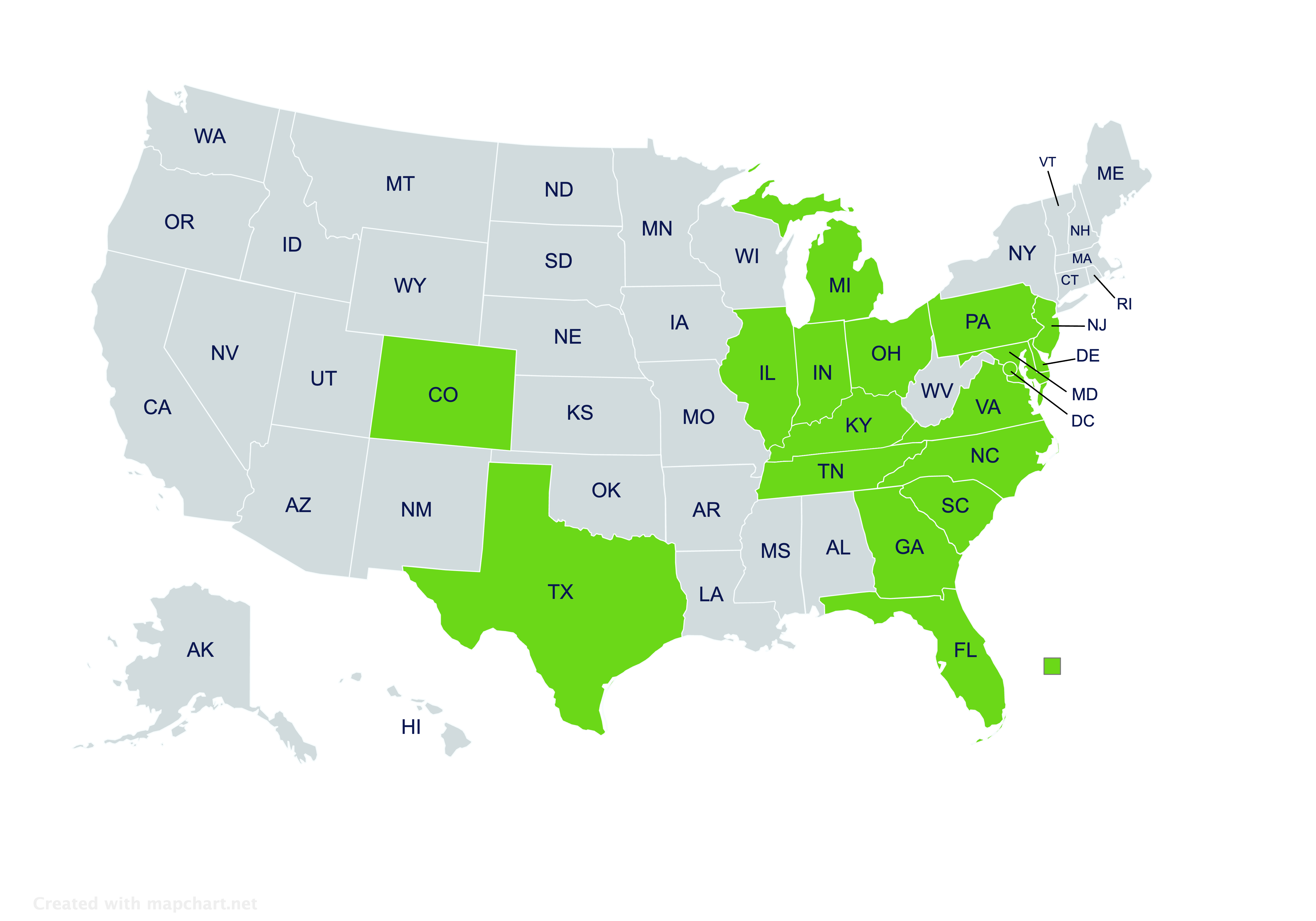

North and South Carolina Areas Served:

Charlotte, NC

Mooresville, NC

Concord, NC

Huntersville, NC

Matthews, NC

Mint Hill, NC

Harrisburg, NC

Gastonia, NC

Rock Hill, SC

Tega Cay, SC

Greenville, SC

Spartanburg, SC

Workers Comp Rates

Workers compensation policies are rated on the following factors.

- Total Payroll– How much do you payout out annually to your employees and uninsured subcontractors?

- Class Code– What kind of work do you do?

- Experience Mod– How long have you had a previous workers comp policy and have there been any losses?

The factors for rating workers comp policies are not complicated. Clearly the amount of your annual payroll is the most important factor. You take that number and multiply it by your class code ratio and the product is the rate you will get. If you have an experience mod or ex mod then that can raise or lower rate. The class code would be much higher for a roofer than for an office worker.

For example:

1) Total Payroll: $100,000 2) Class Code: Painter 5% or .05 3) Experience Mod: 1.0 or (no modifications given)

$100,000 X .05=$5,000 X 1.0= $5,000 annual premium per year.

An ex mod can hurt you if you have prior claims on workers compensation, 1.10 for example. $5,000 X 1.0=$5,500

An ex mod can help you if you had prior insurance and no claims for 3 years, .85 for example. $5,000 X .85=$4,250

Workers Compensation Audits

When determining your workers comp rates, companies can only rate based on your payroll estimates. You give your agent an estimated annual payroll for each class code. You will pay the premium based on this. At the end of your policy term, you will have a workers comp audit to determine your actual rate. If you over-estimated your payroll, you will get a refund. If you under-estimated your payroll, you will owe an additional premium.

Working hours

Open | Mon-Fri 9am – 5pm

Closed | Sat-Sun & Holidays

Office

Social profiles

Let Pegram Insurance Find You Better Coverage for a Lower Price

Get a quick insurance quote and start saving money today!