Landscaping Insurance in North Carolina

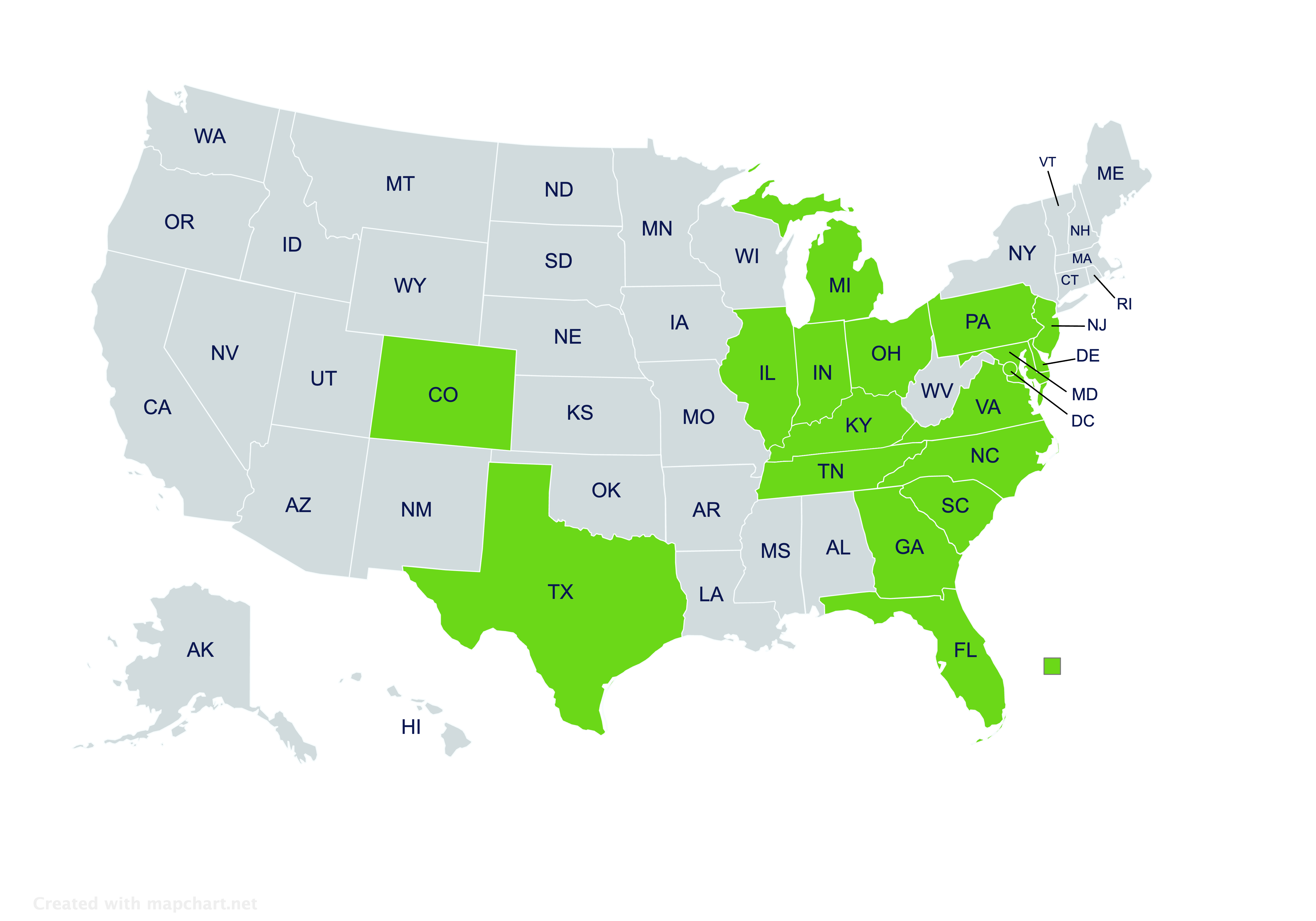

Providing landscaping insurance solutions to residents in North Carolina and beyond.

Get a Quote

Send us your information for a free quote!

Landscaping Insurance in North Carolina

What is landscaping insurance?

Landscaping work involves some risk. Equipment can cause injuries, over-treatment can damage plants, drivers can be in accidents, and any number of other things might go wrong. To help protect against many of the risks that come with this work, landscapers in North Carolina can get landscaping insurance.

Landscaping insurance policies offer tailored coverage for those in the landscaping and lawn care industry. Policies usually come with coverages that help protect against liability and property risks.

What businesses in North Carolina should have lawn care insurance policies?

Most businesses offering landscaping or lawn care in North Carolina ought to have lawn care insurance. Policies usually can protect both types of businesses, and not insuring could prove costly.

Moreover, it’s broadly recommended that businesses insure regardless of their size. Here are some examples of different businesses which might get one of these policies:

- Self-employed individuals mowing yards full-time

- Individuals mowing a few yards part-time as a side hustle

- Local businesses offering landscaping and lawn care

- Statewide businesses with services in multiple locales

- Residential landscapers and lawn care providers

- Commercial landscapers and lawn care providers

Do individuals need lawn care insurance when mowing neighbors’ yards?

Whether individuals need some type of lawn care insurance when mowing a neighbor’s yard generally depends on whether they’re paid.

If unpaid and simply mowing as a favor, any accidents may be covered under a homeowners insurance policy. If the neighbor pays, then accidents probably wouldn’t be covered by homeowners insurance. A lawn care policy might be needed in situations where money (or other compensation) exchanges hands. The same broadly applies to mowing a family member’s or friend’s yard.

Should a lawn care policy be needed, an insurance agent who specializes in lawn care policies can see what affordable options are available.

What coverages can landscapers get through their insurance policies?

Landscaping policies can offer landscapers and lawn care providers many coverage options. Most can be classified as either liability coverages or property coverages.

Liability coverages are mainly for situations where a landscaper could be sued or fined. Some of the more common liability protections that these policies can come with include:

- General Liability Coverage: Often covers common (non-vehicle) accidents that result in injury or property damage to someone else.

- Errors and Omissions Coverage (E&O): Often covers errors made while advising clients on the planning or management of their landscape features.

- Product Liability Coverage: Often covers injuries or damage caused by pesticides, fertilizers, herbicides, or other treatments that are applied.

- Environmental Liability Coverage: Often covers environmental harm to the immediate area that’s caused by leaks, spills, or over-application of treatments.

- Commercial Auto Coverage: Often covers vehicle accidents that work trucks and vans are involved in, and possibly other causes of vehicle damage.

- Commercial Umbrella Coverage: Often provides extra coverage against major liability lawsuits that exceed one of these other protections.

Property coverages are mainly for situations where a landscaper’s assets are stolen, damaged, or destroyed. Different types of property coverages may cover different assets:

- Commercial Building Coverage: Usually protects an office building, garage, or storage facility owned by the landscaping or lawn care business.

- Commercial Contents Coverage: Usually protects landscaping and lawn care equipment when kept at the garage or storage facility. Lawnmowers, trimmers, spreaders, chippers, lifts, chainsaws, trailers, and other equipment may be covered, as can plants, seeds, and treatments.

- Inland Marine Coverage: Usually protects landscaping and lawn care equipment when loaded onto vehicles or trailers, and also may cover treatments, plants, and seeds during transport between locations.

- Equipment Breakdown Coverage: Usually protects critical landscaping equipment, such as mowers, chippers, and lifts, against unexpected breakdowns, possibly paying for emergency repairs.

Where can North Carolina landscapers find landscaping insurance?

If you run a landscaping or lawn care business in North Carolina, let us at Pegram Insurance help make sure your business is properly insured. Our independent agents will work with you to identify coverage needs. They can then show you suitable landscaping insurance policy options from several different insurers, and help you select the best one.

Working hours

Mon-Fri 9 am -12 pm and 1 pm – 5 pm

By Appointment Only: 12 pm – 1 pm

Office

Social profiles

Get in touch!

For questions or insurance quotes, contact us today!