Plumbing Insurance in North Carolina

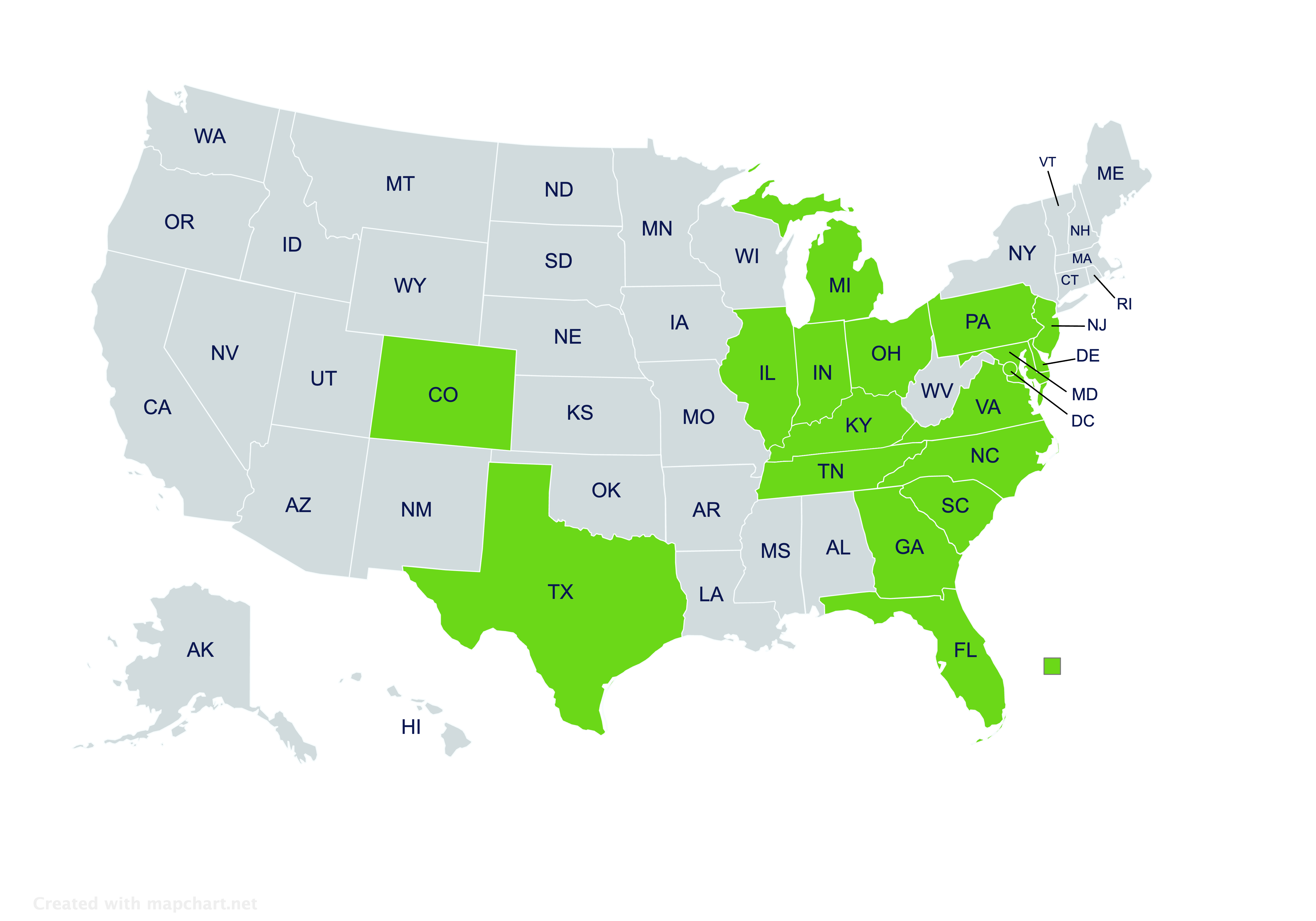

Providing plumbing insurance solutions to residents in North Carolina and beyond.

Get a Quote

Send us your information for a free quote!

Plumbing Insurance in North Carolina

What is plumbing insurance?

Working as a plumber can be a solid career, but it’s not one without risks. From equipment theft to car accidents, there’s plenty that can go wrong. Plumbing insurance may financially help North Carolina plumbers when something happens.

Plumbing insurance offers tailored protections for plumbers and their businesses. Policies typically come with liability and property coverages, in order to protect against a range of risks.

What businesses in North Carolina need to have plumbers insurance?

Plumbers insurance is broadly recommended for most businesses that offer plumbing services. Residential plumbers, commercial plumbers, and self-employed plumbers in North Carolina might get a policy.

Without insurance, the financial costs of replacing equipment or settling a lawsuit could be financially disastrous. A policy might help cover such expenses if something happens.

What insurance protections can plumbers insurance come with?

Depending on the particular policy, plumbers insurance might include the following protections:

- Commercial Property Coverage: May insure a facility, plumbing equipment, and tools that a plumber owns. Protection might also extend to plumbing supplies and fixtures kept at a facility.

- Inland Marine Coverage: May insure plumbing equipment, tools, supplies, and fixtures while they’re being moved between a facility and a customer’s location.

- Installation Floater Coverage: May insure plumbing fixtures and supplies that are purchased for specific jobs, often protecting them from the time of purchase until they’re installed.

- Commercial Auto Coverage: May insure commercial cargo vans or work trucks that a plumbing business owns.

- General Liability Coverage: May insure against common (non-auto) accidents that result in a customer’s injury or property damage.

- Errors and Omissions Coverage: May insure against incorrect advice that’s given to customers when consulting on repairs or installation (E&O).

- Commercial Umbrella Coverage: May provide additional insurance protection, offering an extra layer of liability coverage in case there’s a major covered lawsuit.

Is gas work covered by plumbers insurance?

Some plumbers policies cover working with natural gas or other gasses, but not all do. Plumbers who work on gas lines and appliances should consult with an insurance agent who understands plumbers policies well. An agent who specializes in these policies will be able to check which ones provide strong coverage for gas services.

Can one plumbers policy cover both residential and commercial plumbing?

Many plumbers policies can provide coverage for both residential and commercial plumbing. A knowledgeable insurance agent can confirm that a chosen policy properly covers all of the work that a plumber does.

How can plumbers obtain a certificate of insurance?

A certificate of insurance (COI) might be used to show that a plumber has specific insurance coverages. It’s a document that’s issued by an insurer once a policy is purchased, and sometimes requested by potential customers. Commercial customers, in particular, may want to see a plumbers COI before hiring them.

If a customer asks to see a COI, an insurance agent can help obtain one. The process is usually quite quick, and often takes no more than a day.

How much are premiums for plumbers policies?

The premiums charged for plumbers policies are based on many factors, and they vary from one situation to another. A plumber’s location, the size of their business, and the services they offer (e.g. whether they do gas work) can all impact cost. So too can any recent claims, the chosen coverages and limits, and much more.

In order to find out how much insurance will cost in a specific situation, plumbers can compare policies with an independent insurance agent. An independent agent can request quotes from several insurance companies, since they aren’t connected to just one.

Where can North Carolina plumbers get plumbing insurance?

If you’re a plumber and need help with insurance, contact the independent insurance agents at Pegram Insurance. Our North Carolina agents will work closely with you, to find a plumbing insurance solution that protects your business well.

Working hours

Mon-Fri 9 am -12 pm and 1 pm – 5 pm

By Appointment Only: 12 pm – 1 pm

Office

Social profiles

Get in touch!

For questions or insurance quotes, contact us today!