Restaurant Insurance in North Carolina

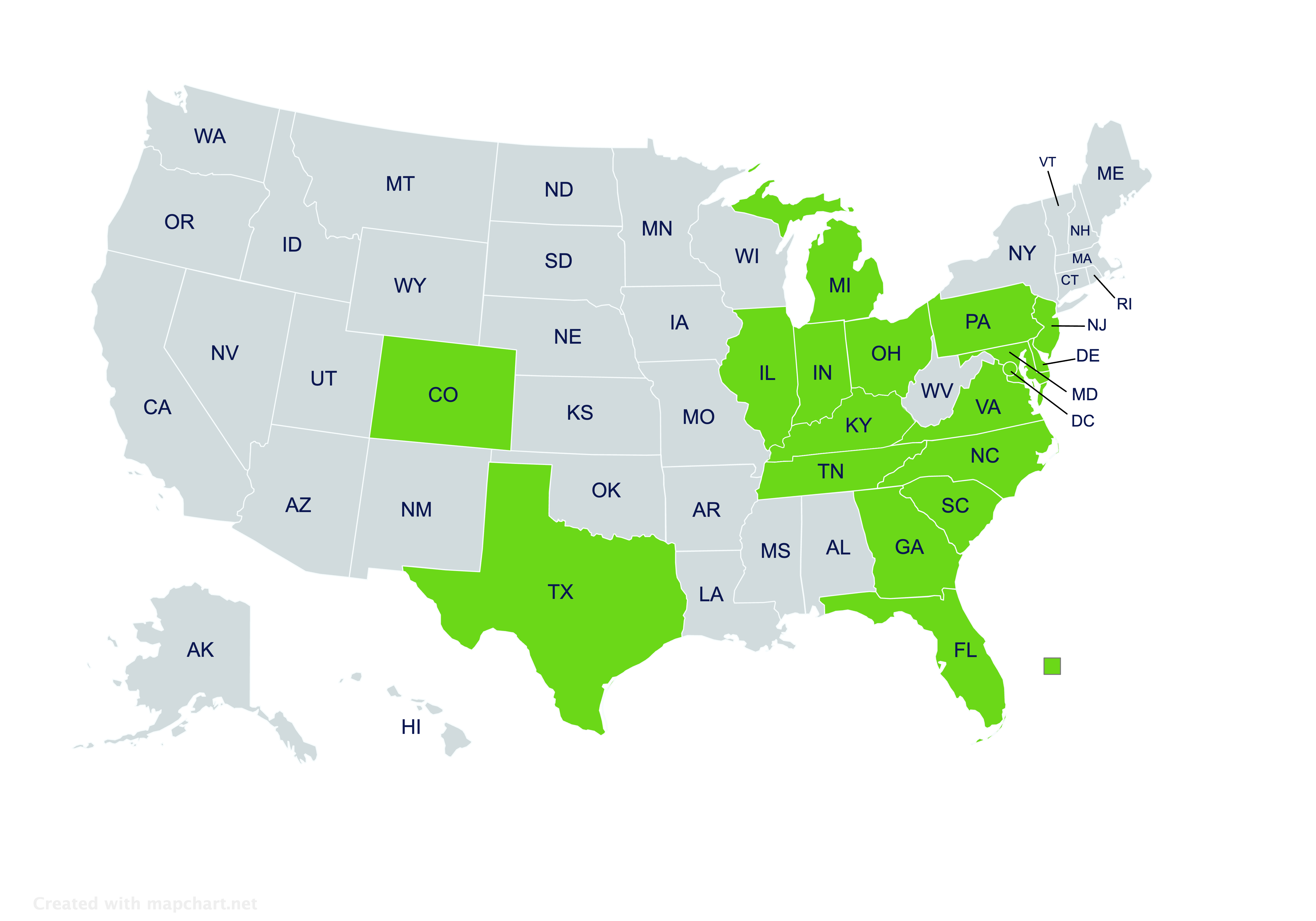

Providing restaurant insurance solutions to residents in North Carolina and beyond.

Get a Quote

Send us your information for a free quote!

Restaurant Insurance in North Carolina

What is restaurant insurance?

Running a restaurant is a multifaceted operation, and it comes with multiple risks. Restaurant insurance may help food service businesses in North Carolina shield themselves from a variety of risks that they’re exposed to.

Restaurant insurance provides tailored protections for sit-down restaurants. Policies normally come with both restaurant liability insurance and property insurance coverages.

Which North Carolina restaurants are restaurant policies for?

Restaurant policies are recommended for most sit-down restaurants in North Carolina. Not insuring can be costly if something happens, and these tend to be the best option if offering sit-down dining.

For example, restaurant policies are frequently used to insure:

- Fine dining restaurants (e.g. steakhouses, seafood restaurants)

- Casual restaurants (e.g. diners, buffets, family-friendly places)

- Cafes (e.g. bistros, coffee shops, delis with table service)

- Fast food places (e.g. chains, fast-casual eateries, pizza places)

- Eco-focused places (e.g. vegetarian places, farm-to-table restaurants)

Food service businesses that don’t offer sit-down dining might need many similar coverages, but they’ll likely find that a caterer insurance policy, food truck insurance policy, or other another policy is better suited for their particular risk exposure.

What insurance coverages can restaurant policies come with?

Restaurant policies can come with a variety of liability coverages and property coverages. Restaurant liability insurance coverages may protect against a variety of situations where a restaurant might be financially responsible for another party’s harm. Property insurance coverages may protect a range of assets that restaurants own.

The following are some examples of restaurant liability insurance coverages that policies usually can include among their protections:

- General Liability Coverage: Could protect against common accidents involving third parties, namely customers or vendors. Typically also covers defamation and false advertising lawsuits.

- Product Liability Coverage: Could protect against injuries or illnesses that food or beverages cause. Choking on a bone, contracting salmonella from mishandled food, and similar events might be covered.

- Liquor Liability Coverage: Could protect against accidents and other incidents wherein an intoxicated customer is hurt or causes harm. Typically applies to common accidents, DUI accidents, sexual assaults, other assaults, and cases of alcohol poisoning.

- Umbrella Liability Coverage: Could give additional protection in case there’s a lawsuit that exceeds one of these other restaurant liability insurance coverages’ limits.

Property insurance coverages that are normally available within restaurant policies include:

- Commercial Building Coverage: Might cover a restaurant’s physical location, often including a building, any outdoor dining areas, and a parking lot. Protections normally apply if the restaurant owns its building.

- Tenant’s Betterment Coverage: Might cover the improvements that a restaurant makes during the build-out of a leased space. Protections normally include changes to both the back of house, and the front of house.

- Commercial Contents Coverage: Might cover BOH appliances, serveware and tableware, furniture, decor, computers and a POS system, among other things that aren’t permanently installed.

- Food Contamination Coverage: Might cover food ingredients and prepared meals against spoilage that’s caused by certain events, such as a power outage.

Do restaurants need specific protections if they host private events?

Hosting private events, like company parties, rehearsal dinners, major birthday parties, and fundraisers, might increase a restaurant’s risk exposure. Whether any additional risks are already adequately covered by a restaurant policy depends on the terms of that particular policy. Sometimes no additional protections are needed, but other times a policy should be amended with additional protections or higher limits.

An insurance agent who specializes in restaurant liability insurance can help evaluate whether a policy adequately covers hosting private events, or if additional protections are needed.

Where can North Carolina restaurants find restaurant insurance?

For help insuring a restaurant that’s located in North Carolina, contact the independent insurance agents at Pegram Insurance. Our agents will work closely with you to find a restaurant insurance policy that’ll protect your business well.

Working hours

Mon-Fri 9 am -12 pm and 1 pm – 5 pm

By Appointment Only: 12 pm – 1 pm

Office

Social profiles

Get in touch!

For questions or insurance quotes, contact us today!