Auto Insurance Quotes for Charlotte, NC

Get a better price on your car insurance in Charlotte with Pegram Insurance.

We shop the best auto insurance rates from 30 insurance companies so you save money on your auto insurance.

Get a Quote

Send us your information for a free quote!

We Can Get You Better Auto Insurance Coverage for Less Money.

How is That Possible?

We shop multiple insurance companies to find you a better price on your Charlotte car insurance. Call us for a quote and we’ll prove it.

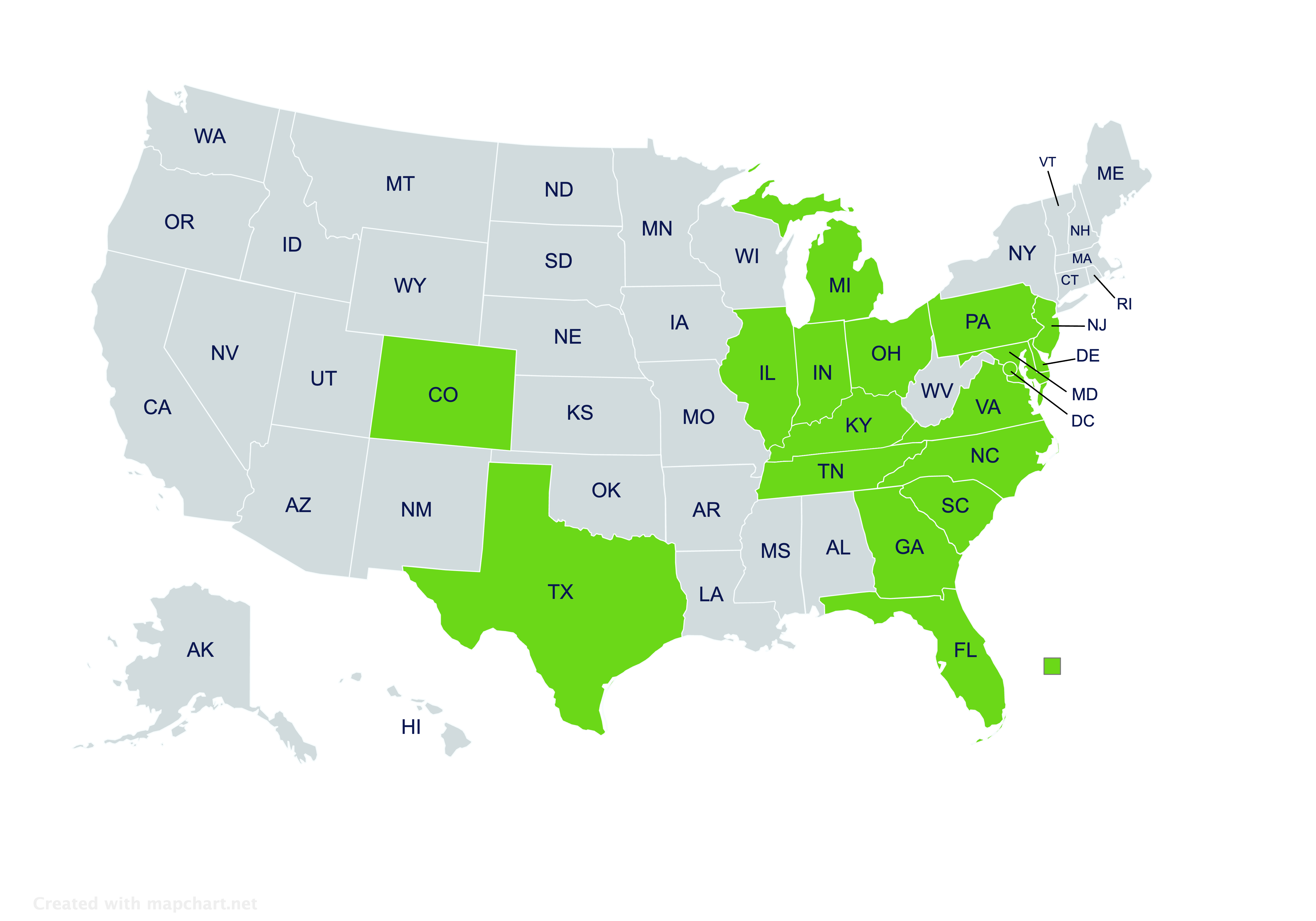

We have been the favorite local independent insurance agency in Charlotte, NC and the surrounding areas for the last decade. We provide car insurance from multiple insurance companies and we offer these great car insurance rates to our customers in Charlotte, NC and all of North Carolina and South Carolina. This is what separates us from the others. When you get a quote from us, we are able to shop multiple companies that we represent so we can provide you with several car insurance quotes. We realize that every individual is different so we fine-tune your insurance requirements based on the coverages that you want and then shop our A-Rated carriers to find your lowest auto insurance rate. Within 10 minutes we can provide you with this service and at no cost to you.

We will provide you with instant DL 123, SR 22, FS 1, and FR 2 forms that are required by NC and SC once we issue your policy. We offer the best rates for drivers with no points with our incident-free discounts. We also offer the best Charlotte auto insurance and NC and SC auto insurance rates for those with not so clean records as well. This can include drivers with a DUI DWI, tickets, or accidents. We also offer non-owners insurance or named-operator insurance policies for drivers just getting their license that don’t have a car. Whether you have no experience or several years experience, we have a policy for you.

You can be certain that when you call us you will not be entered into a call center where you wait for the next available representative. You will reach the same friendly local agents each time you call us. The services we provide won’t stop once you call us for a quote. We continually strive to provide you with excellent service as long as you are our customer. We shop your renewals with our carriers as well to make sure that you continue to be offered the best auto insurance rates available. So if you are in the market for Charlotte auto insurance or NC and SC auto insurance please call us at (704) 494-9495 and start saving today.

North and South Carolina Areas Served:

Charlotte, NC

Mooresville, NC

Concord, NC

Huntersville, NC

Matthews, NC

Mint Hill, NC

Harrisburg, NC

Gastonia, NC

Rock Hill, SC

Tega Cay, SC

Greenville, SC

Spartanburg, SC

How Do You Want to Get Your Insurance Quote?

Pick from 3 convenient options

Recent Insurance Customer Reviews

⭐⭐⭐⭐⭐

“Corey is always available to answer any questions about my policies and works to find me the most cost-effective insurance. I feel like a person and not a number when talking to him.”

Ashley Y.

Customer since 2015

⭐⭐⭐⭐⭐

“Dawn made securing home insurance so easy! After getting home insurance she also found us car insurance that was half the price of what we were paying. Can not say enough about how great Dawn is!”

Kelly C.

Customer since 2018

⭐⭐⭐⭐⭐

“The team at Pegram Insurance in Charlotte is always helpful and finds the best insurance value every time. We’ve saved thousands since moving all of our insurance to Pegram! Just give them a call.”

Christopher M.

Customer since 2016

Comparing Car Insurance Rates in Charlotte, NC?

I am going to tell you the best way to do it and how to get the best rates on your Charlotte car insurance.

Since we represent most of the insurance companies available in Charlotte, we know a thing or two about car insurance here. Who has the best rates in Charlotte? We will tell you. There are several factors that are considered when rating auto insurance. We will discuss those and some ways you can save the most money on your car insurance rates.

Shopping Charlotte Auto Insurance Companies

You would need a crystal ball to know which insurance company is going to offer you the best rates. The only way to truly know is to quote every single company that sells car insurance in NC. We know you don’t have time for that. So what is the next best option? Your best bet is to find an independent insurance agency that represents the most companies. We shop to find our clients the best rates. In order to win more than 70% of the time, we have to represent the majority of insurance companies in Charlotte. It is just the law of numbers.

Don’t focus on bundling with one company. In most cases you can fall into a trap on that. The reason is, it is unlikely that one company will offer you the best rate on your auto insurance, home insurance, business insurance and motorcycle insurance. If a company is low on car insurance, they will likely be higher on one of those other lines. They typically have to make up for low rates on one policy with higher rates on another.

An independent insurance agency can spread your policies around to the best company on each line of business. They can also offer bundle discounts, in many cases, just for having your other policies with the agency. The end result is you save the most money on each policy. That is what we do with our own policies and that is what we do with our clients as well.

Even if you could find one place online that you could quote all companies yourself (you can’t), you don’t always know everything you need to know regarding the insurance coverage. That is why it is imperative to find an agent you can trust to do it for you. One that has your best interests at heart and can provide all of the insurance discounts needed to offer you the best rate.

So you found an agent that can help you shop multiple companies. What is next? We will discuss what factors play a role in getting you the best rate in Charlotte, NC.

Charlotte Insurance Rates by Zip Code

In the past in NC, zip codes played a much smaller role in car insurance rates. Today the rates can be vastly different. There is a lot of data that is looked at to determine what zip codes should have higher rates and which should be lower. They look at the chances of accidents and theft when making these determinations.

I can’t say I agree with the actuaries completely on this. I agree they should play small role, but we have seen rates go up as much as 30% when a client moves from a preferable zip code to one that is higher rated. First of all, the zip codes in Charlotte are pretty large. In many cases there are pockets where the accidents and thefts are occurring much more than other areas within the same zip code. In addition, very few people work in the same zip code that they live in. This work address isn’t picked up on the risk and we all spend a significant time at work which leads to our vehicles spending time there too. It isn’t just the commute either. If you go out for lunch or to run errands during a break, you may be more likely to have a loss around work than home.

For those that live outside of Charlotte, your rates are cheaper. If you live in Concord, Harrisburg, Waxhaw, Matthews, etc then you will see a significant rate reduction then those living in Charlotte. This is true even if you work in Charlotte. Below is a breakdown of some of the higher and lower zip codes.

Cheapest Charlotte Zip Codes: 27277, 28227, 28226, 28210

Highest Charlotte Zip Codes: 28216, 28262, 28269, 28213

Charlotte Population

Charlotte, NC is the 16th largest city in the nation. We are just above Indianapolis and just under San Francisco. The estimated population as of 2019 is 872,500. This is a 19% increase in just 9 years. To say that Charlotte is growing is an understatement. In fact, Charlotte, NC is the 5th fastest growing city in the US behind Phoenix, AZ; San Antonio, TX; Fort Worth, TX; and Seattle, WA.

With population increases like these, along come increases in crime and accidents as well. These things will dramatically effect car insurance rates. Each time companies take large losses, they will raise rates to incorporate their profit margins in what is called loss ratio. Insurance companies are in the business of making money after all. If they incur more losses, the only other option is to raise rates to lower their loss ratio and increase their profitability.

Charlotte Insurance Driving Experience Years

The number of years you have had your license has the largest impact on your rates. The reason for this is statistics overwhelmingly show a correlation for new drivers and accidents. Currently the inexperience rating factor is incremental starting with 0 years experience and phasing out at 3 years. This means that you pay the highest when you have under 1 year of experience and your rates go down for each year you have been licensed.

A lot of people believe car insurance is rated based on your age. This isn’t true. It is solely based on when you first obtained your license. This means if you first got your license at the age of 40, you will still pay higher rates as if you were 16 years old.

Keep a watchful eye on the House Bill HB 221 that is in the NC General Assembly currently. If approved, this will increase the number of years that you can face higher inexperienced rates in addition to charging any violations of 4+ points for a longer number of years.

Charlotte Insurance with Tickets and Claims

The quickest way to raise your insurance rates is to cause an accident or to get a speeding ticket. Your car insurance rates can go up 30-40% just for one of those unfortunate events. The more you get, the more your rate goes up.

Accidents are settled as either not-at-fault, 1 point, 2 points, or 3 points. The more points an accident is, the higher surcharge on your auto insurance policy. You need to weigh this when you decide whether to file a small claim or not. Depending on the company’s underwriting guidelines, this can effect you for 3 years or as much 5 years.

Other Discounts on your Charlotte Car Insurance

There are many factors that effect your rate on Charlotte car insurance other than your driving experience, zip code, vehicle and driving record. Some may surprise you. I will mention several with explanations

Credit Rating

Most companies will adjust rates depending on your credit rating. If you have worked hard to maintain excellent credit, then this will be very pleasing to you. If you haven’t, then not so much. Either way most companies will rate based on this factor. Favorable credit can save you hundreds of dollars per year so it pays to clean it up if your credit rating is less than stellar.

Marital Status

That’s right. Your marital status can effect your rate as well. Marriage is more than just blissful love and tax benefits. It will also save you on your auto insurance as well.

Incident Free Discount

This one is relatively new. It used to be that if you were involved in an accident that was not your fault, it would not impact your rate in any way. Not so anymore. A lot of companies will give you an additional discount if you have had no driving incidents. This includes being free of not-at-fault accidents, waived speeding tickets and accidents, and even those improper equipment rulings you paid your attorney to get you out of that speeding ticket. These items don’t vastly increase your rates but it will make a difference with many companies. It is always helpful if your driving history is blemish free.

Gender

This one is new in NC as well. Other states have rated males higher for quite some time now. Yes even way back when I got my license this was the case. NC did not base rates on gender at all for a long time. They do now. It isn’t excessive, but you pay a little more. Females do typically mature faster than males and statistics don’t lie.

Length of Prior Insurance

Having prior insurance will impact your rates. Some companies won’t write your policy at all without prior insurance. Others give larger discounts if you have had it. Still others look at the length of prior insurance with your previous insurance company. Call it a loyalty credit for how long you were with your prior company. The new company hopes you will do the same with them. Most insurance companies don’t make any money until you renew your policy after all. This is due to the increasingly higher costs of doing business and the expenses of running motor vehicle reports.

10 Largest Auto Insurance Companies in NC

Below is the list of the largest companies in NC by market share on written premium. Combined they make up over 86% of the market share in NC. After these top 10, it is very much spread out from there.

- State Farm

- Geico

- Nationwide

- National General

- NC Farm Bureau

- Allstate

- USAA

- Progressive

- Erie Insurance

- Liberty Mutual

Top Charlotte Insurance Companies by Risk Type

Charlotte car insurance has become more complicated to rate than ever before. When shopping our clients in the past, we could very intuitively choose which company will win on a certain risk type. Due to an increased number of rating factors, it is much harder to guess which companies will be the best with each risk type. With that said we will give several scenarios along with the insurance company that would likely offer the best rates in Charlotte.

Experienced drivers with excellent credit, prior insurance, and no prior driving incidents:

- National General

- Progressive

- Geico

Driver with a DWI conviction:

- National General

- Dairyland

- Progressive

Mom and Dad with a child in the household that is a new driver:

- Travelers

- National General

Driver with 3 or more accidents in the last 3 years:

- Dairyland

Clean driver with previous military service:

- USAA

NC Minimum Liability Requirements

North Carolina has minimum liability requirements of $30,000 bodily injury each person, $60,000 bodily injury each accident, and $25,000 property damage each accident. These split limits are commonly referred to as 30/60/25 in shorthand.

These limits have been the same for way too long. In today’s dollars, these amounts don’t go too far. We recommend having at least 100/300/100 on your policy. A large percentage of vehicles purchased new are well over the $25,000 minimum property damage required. That that means is if you hit a car over $25,000, you are responsible for the rest.

At the very least you should purchase one step up from the minimum 30/60/25 limits and choose 50/100/50. Some people will try to protect themselves with limits 250/500/100 and further protect themselves with an umbrella policy over top of that. I believe the small change in premium is worth the peace of mind that you are covered if an accident occurs. Also, companies increase your discount for having prior insurance if your limits were higher with your previous insurance company.

Charlotte Car Insurance Rate Compared to NC and the US

NC has some of the cheapest auto insurance rates in the nation. In fact compared to the rest of the United States, we are the 5th lowest in the nation. Charlotte just happens to have some of the highest rates in NC though. As stated earlier, this becomes much more complicated when zip codes are taken into consideration. Some of the lower zip codes in Charlotte may see lower rates than higher zip codes in other towns, even though that town itself offers lower overall rates than Charlotte does.

To conclude, there are more factors used to rate an auto insurance policy today then ever before. Insurance actuaries are always trying to find new ways at assessing risk. This means that shopping for car insurance rates are harder now as well. It is probably more important now than ever to have a knowledgeable agent as your advocate to ensure you are getting the best rates. We have saved our customers hundreds and even thousands of dollars by using our vast knowledge and number of insurance companies to their advantage.

If we can help you with your car insurance or answer any further questions, please don’t hesitate to reach out to us at 704-494-9495.

Working hours

Open | Mon-Fri 9am – 5pm

Closed | Sat-Sun & Holidays

Office

Social profiles

Let Pegram Insurance Find You Better Coverage for a Lower Price

Get a quick insurance quote and start saving money today!