Liquor Liability Insurance in North Carolina

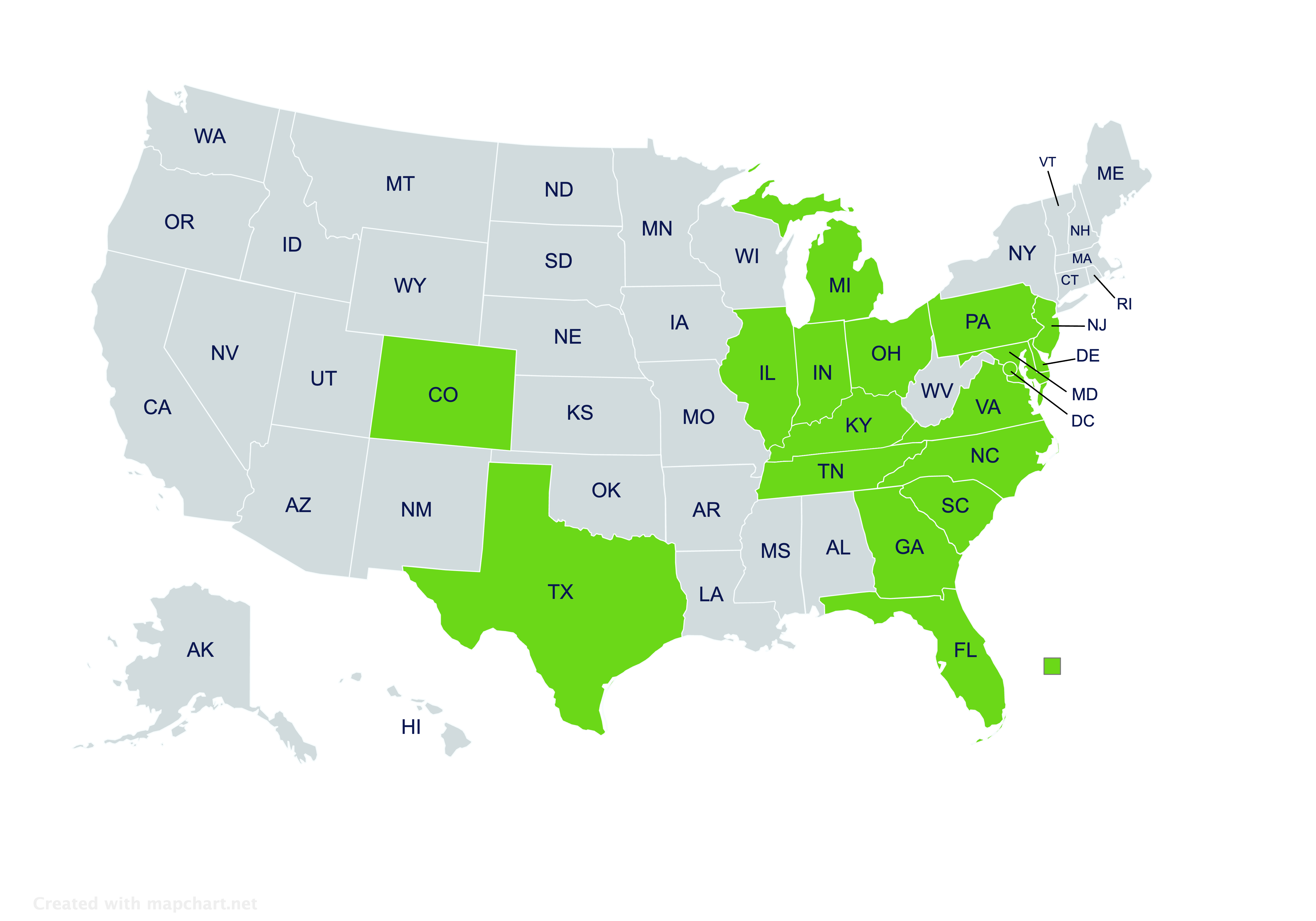

Providing liquor liability insurance solutions to residents in North Carolina and beyond.

Get a Quote

Send us your information for a free quote!

Liquor Liability Insurance in North Carolina

What is liquor liability insurance?

Selling alcoholic beverages comes with some risks. Businesses may be held liable for overserving if an inebriated customer is involved in an accident or other incident. Liquor liability insurance may help businesses in North Carolina that sell alcohol protect themselves from such risk.

Liquor liability insurance provides specialized coverage for businesses that sell alcohol. Coverage may insure against the legal fees and any settlement if there’s a covered alcohol-related lawsuit.

What businesses in North Carolina need to have liquor liability coverage?

Although North Carolina generally doesn’t require liquor liability coverage, insuring is broadly recommended if applying for a retail liquor permit. Serving beer, wine, spirits, or mixed drinks may call for a policy.

This recommendation broadly applies regardless of whether drinks are served on premises, tastings are offered on-premises, or beverages are sold for consumption elsewhere. It also broadly applies regardless of whether drinks are sold or given for free.

In short, liquor liability might provide important protections anytime alcohol is served or sold. Not insuring could be costly if something involving an inebriated customer happens.

What sorts of incidents can liquor liability coverage protect against?

Depending on a policy’s specific terms, liquor liability might protect against a variety of incidents wherein an inebriated customer is injured or causes harm:

- “Slip and fall” accident involving the intoxicated customer

- Assault (sexual or otherwise) perpetrated by the intoxicated customer

- Fight resulting in injury to someone directly involved or a bystander

- DUI accident caused by the customer after they leave the business’s premises

- Hospitalization of the customer due to alcohol poisoning

An insurance agent specializing in liquor liability can review the particular types of incidents that a particular policy might insure against.

Does general liability cover slip and fall accidents involving an inebriated customer?

While general liability insurance often covers slip and fall accidents, accidents inebriated customers are frequently excluded. One of the main protections that most liquor liability policies provide is filling in this gap, usually covering these accidents if an inebriated customer is injured.

When do nonprofit organizations need liquor liability coverage?

Nonprofits may want liquor liability for any events where they offer adult beverages, regardless of whether they charge for the drinks.

Nonprofits that regularly serve alcohol might get a standard liquor liability policy. More often, an event insurance policy can provide liquor liability coverage for a short time. This often makes coverage for fundraisers or festivals quite affordable.

Do businesses need liquor liability for company parties?

Similar to nonprofits, businesses also may want liquor liability if they’re offering alcoholic beverages at a specific event. Coverage is often recommended if hosting holiday parties, corporate retreats, company picnics, or any other events where employees are offered drinks.

Again, short-term coverage may be available for these sorts of events. An insurance agent who understands liquor liability well can help check what policies offer the necessary protection at an affordable rate.

Can liquor liability be bundled with other insurance coverages?

Commercial package policies make it easy to bundle liquor liability with other coverages. Businesses regularly get it along with general liability, commercial umbrella, commercial property, and many other coverages.

How much does liquor liability cost?

The cost of liquor liability varies, depending on factors like the following:

- Total annual revenue

- Percent of sales stemming from alcohol

- Types of alcoholic beverages sold

- Any recent liability insurance claims

To find out how much coverage will cost in a particular situation, businesses can shop around with an independent insurance agent. An independent agent will be able to check policies from several insurers.

How can North Carolina businesses find liquor liability insurance?

For help finding liquor liability insurance in North Carolina, contact the independent insurance agents at Pegram Insurance. Our agents will work closely with you to find liquor liability that meets your business’s needs well, and we can assist with many other coverages too.

Working hours

Mon-Fri 9 am -12 pm and 1 pm – 5 pm

By Appointment Only: 12 pm – 1 pm

Office

Social profiles

Get in touch!

For questions or insurance quotes, contact us today!