Limousine Insurance in North Carolina

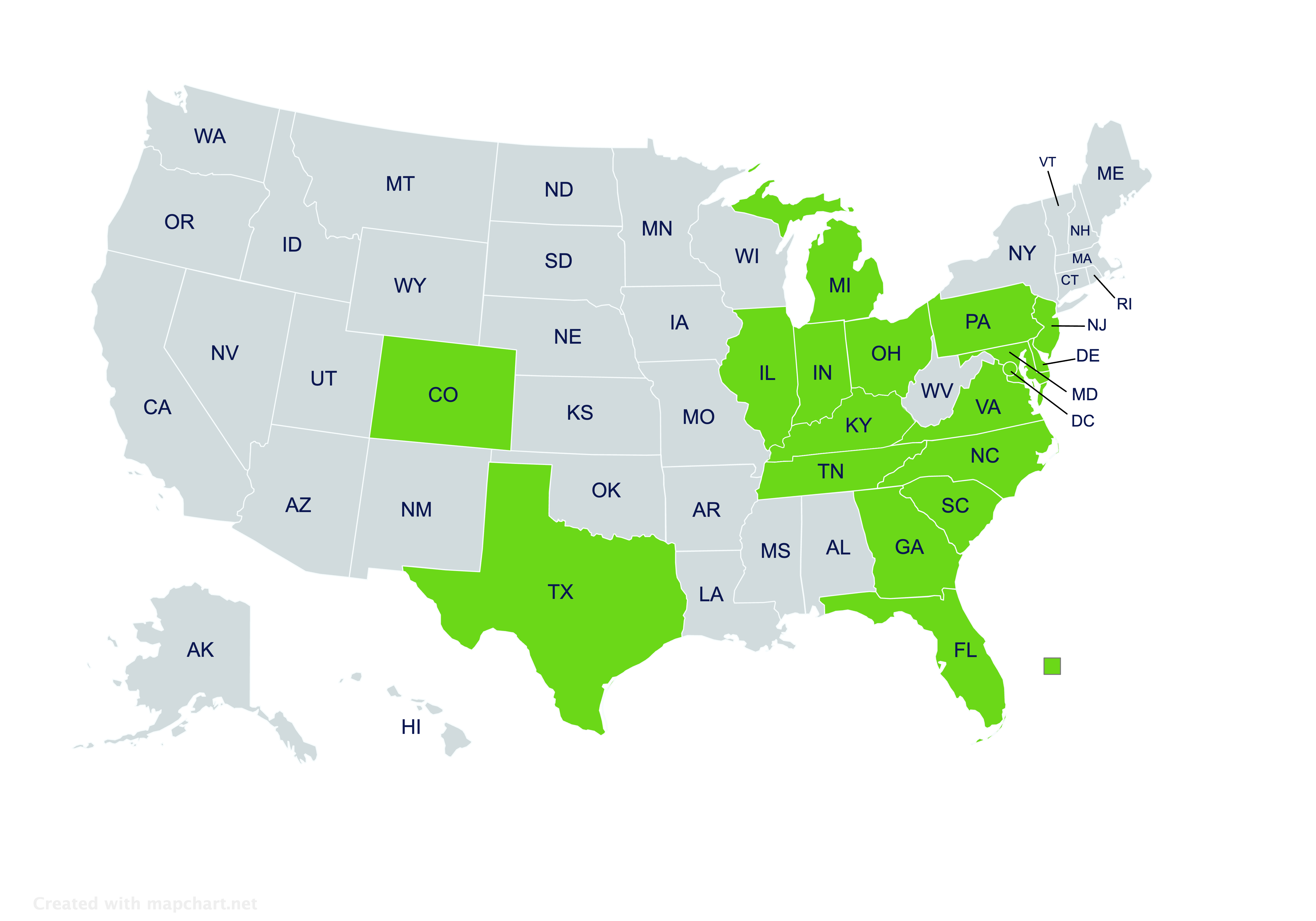

Providing limousine insurance solutions to residents in North Carolina and beyond.

Get a Quote

Send us your information for a free quote!

Limousine Insurance in North Carolina

What is limousine insurance?

Providing luxury transportation can be a fun and profitable career, but it’s work that comes with certain risks. Limousine insurance can help limo drivers and other chauffeurs in North Carolina shield their businesses from a variety of risks.

Limousine insurance offers tailored commercial auto coverage for luxury transport businesses. Policies typically help protect drivers, their vehicles, and their businesses.

What North Carolina businesses need limo insurance?

North Carolina state law generally requires insurance for any commercial vehicles used on public roads. Limo insurance tends to be the best way to insure limousines and other luxury vehicles. Standard limousines, stretch limos, SUV limos, luxury SUVs, and town cars might all be insured with this type of policy.

Do self-employed chauffeurs need limo insurance?

Self-employed drivers who offer limousine or black car services usually still need limo insurance for their vehicles. Coverage is normally required regardless of how large or small a business might be.

What coverages do limousine policies come with?

Limousine policies can come with a variety of coverages. Some common protections that might be standard or optional in a policy include:

- General Liability Coverage: Normally covers common, non-vehicle accidents that cause third-party injury or property damage. For example, a customer falling as they enter or exit a limousine might be covered.

- Personal Injury Coverage: Normally covers injuries that customers or passengers sustain if the limousine is in an accident, and often also covers injuries to persons not in the limo.

- Bodily Injury for Drivers Coverage: Normally covers injuries that drivers sustain during an accident.

- Physical Damage Coverage: Normally covers limousine damage that’s caused by an accident or other incident (e.g. fire, falling tree, animal strike, etc.).

- Property Damage Liability Coverage: Normally covers damage to other vehicles or property that’s caused by an accident.

- Underinsured/Uninsured Motorist Coverage: Normally covers accidents involving a driver who lacks sufficient auto insurance, and also hit-and-runs.

- Employment Practices Liability Coverage: Normally covers employee-filed allegations of discrimination or harassment.

Are passengers’ personal belongings covered by a limousine policy?

The personal belongings of passengers often aren’t covered by a limousine policy. While some policies might offer such protection, it’s far from a standard feature.

Chauffeurs who want to have their passengers’ belongings covered can work with an insurance agent who specializes in limo insurance. A specialized agent will be able to check which policies offer this protection as an option.

Are customizations made to a limo’s interior covered by insurance?

Many limousine policies can cover changes that are made to a limo’s interior. It may be necessary to choose an optional coverage, however. Sometimes the customizations themselves might have to be detailed too.

A knowledgeable agent will be able to help find a policy solution that covers interior customizations, if such protection is needed.

Can taxi cab drivers get insurance through a limousine policy?

While taxi cab drivers might need many of the same coverages as limousine drivers, limousine policies are designed for insuring luxury transport services. Cab drivers will likely find that a taxi insurance policy is slightly better for the type of for-hire driving they do.

Should black car drivers on rideshare platforms get a limousine policy?

Drivers who offer premium “black car” services on rideshare platforms usually don’t need all of the protections that a limousine policy offers. Even though they might be offering premium services on the platform, a rideshare insurance policy will likely be a better choice.

How much do chauffeurs pay when insuring limousines?

The premiums charged for limousine policies vary. Insurance companies base them on many factors, often including:

- Number of vehicles being insured

- Types of limos or luxury vehicles being insured

- Year, make, and model of each vehicle

- Location where the vehicles are kept

- Each chauffeur’s driving record

To find out how much insurance will cost in a particular situation, chauffeurs can shop around with an independent insurance agent. An independent agent will be able to request quotes from several insurance companies that offer these policies.

Where can chauffeurs find limousine insurance in North Carolina?

If you’re a chauffeur in North Carolina and need help finding insurance, contact the independent insurance agents at Pegram Insurance. One of our agents will work closely with you, to find limousine insurance that’ll protect you, your business, and your vehicles well.

Working hours

Open | Mon-Fri 9am – 5pm

Closed | Sat-Sun & Holidays

Office

Social profiles

Get in touch!

For questions or insurance quotes, contact us today!