Roofing Insurance in North Carolina

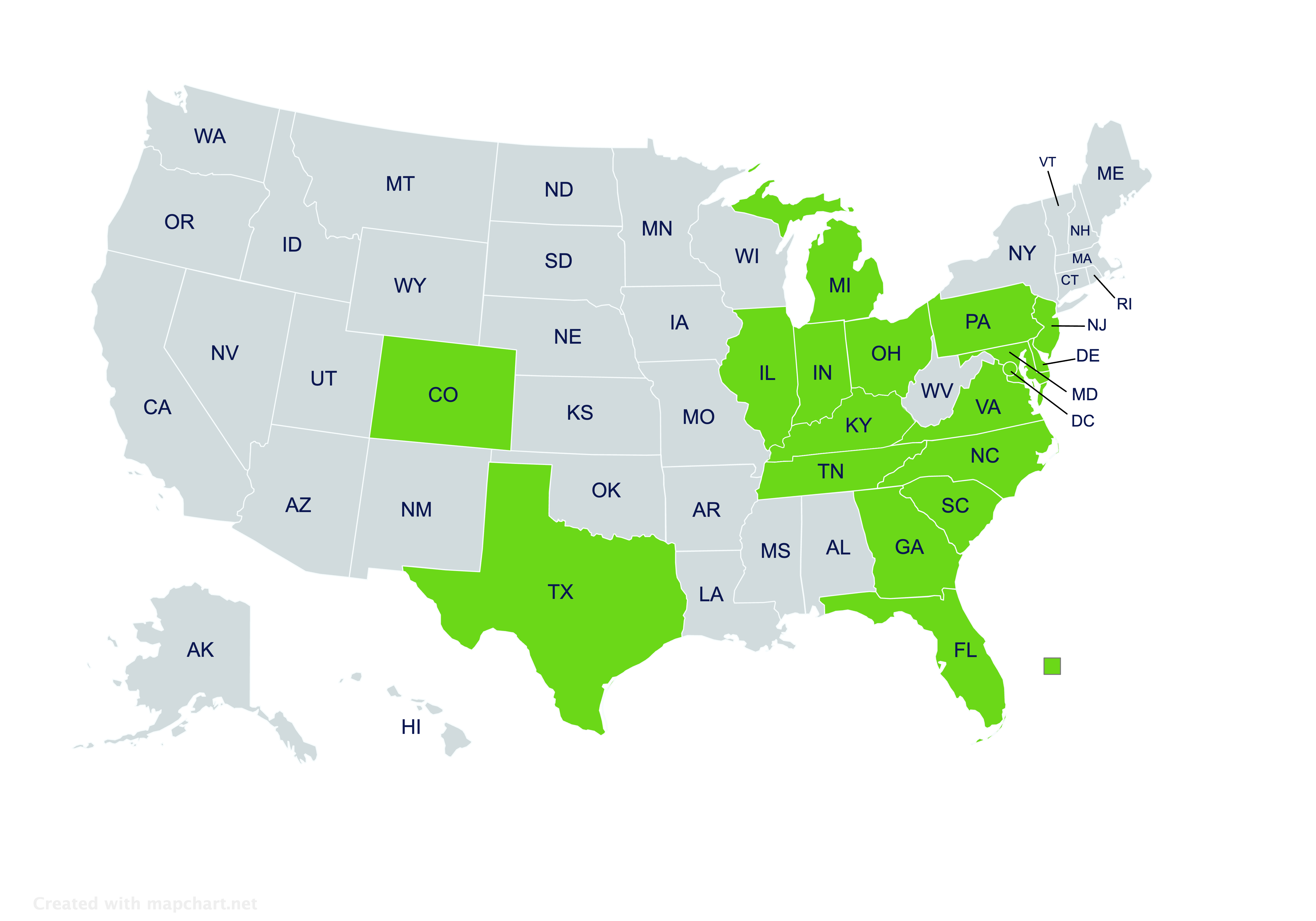

Providing roofing insurance solutions to residents in North Carolina and beyond.

Get a Quote

Send us your information for a free quote!

Roofing Insurance in North Carolina

What is roofing insurance?

Roofing can be profitable work, but it certainly comes with risks. Car accidents, equipment theft, common accidents, and falling off of roofs are just some of the risks that roofing contractors face. To help protect against covered risks, contractors in North Carolina can get roofing insurance.

Roofing insurance offers customizable protections for roofers and their businesses. Roofers may choose from a variety of property and liability coverages.

What roofers in North Carolina need roofers insurance?

Most roofers working in North Carolina should have a roofers insurance policy. Residential roofers, commercial roofers, and those specializing in metal, slate, or tile roofs might all get coverage.

Of course, some in the roofing industry forgo insurance so they can keep overhead minimal. Not insuring can be financially bankrupting if something happens, though. It also can prevent a roofer from getting certain jobs, as customers (especially commercial customers) will only hire insured roofing contractors. For these reasons, coverage is broadly recommended.

What protections can roofers get through a roofers insurance policy?

Roofers insurance policies can make a variety of coverages available. Most are either liability coverages or property coverages. The former primarily insure against situations where a roofer might be sued for causing harm. The latter are mostly for protecting what a roofer’s business owns and uses.

Some roofing liability insurance coverages that most policies make available include:

- General Liability Coverage: Could protect against common accidents that cause property damage or injuries to third parties, usually including accidents at job sites or at a roofer’s facility.

- Professional Liability Coverage: Could protect against injuries and property damage that stems from improperly installed roofing materials.

- Product Liability Coverage: Could protect against injuries and property damage caused by faulty roofing materials, such as shingles or metal sheets.

- Commercial Vehicle Coverage: Could protect against car accidents involving a work truck or van, and usually also protects against other causes of vehicle damage.

- Umbrella Liability Coverage: Could protect against major lawsuits that have costs exceeding another liability coverage’s limit.

Some property coverages that roofing policies usually can come with are:

- Commercial Building Coverage: Might insure a building, such as an office or storage facility, if the roofing business owns one.

- Commercial Contents Coverage: Might insure the equipment, tools, and materials that a roofing contractor keeps at their main location.

- Loss of Income Coverage: Might insure against revenue losses if a roofer is unable to work due to a covered disaster.

For help sorting through these coverage options, roofers can speak with a specialized roofers insurance agent.

Do roofing contractors need to carry workers compensation?

North Carolina state law generally requires that businesses with at least three employees carry workers compensation insurance. The insurance is primarily in case an employee is injured or becomes ill due to their work, and injuries are certainly a risk when working on roofs.

Thus, roofing contractors who have at least three employees usually need to get workers compensation. Small outfits with no, one, or two employees might not legally need the coverage, but it’s still often recommended for just one or two employees.

An insurance agent who’s familiar with roofing policies should be able to assist with workers compensation.

Do roofing policies come with bonds?

Occasionally, roofers working on major commercial projects might be required to obtain a bond for the project. A bond may compensate the customer if the roofing work isn’t completed as contracted.

Roofing policies themselves normally don’t include bonds, but many insurance companies underwrite construction bonds for roofers and other contractors. An agent who knows roofing policies, again, can likely also assist with getting a bond.

How can roofers get roofing insurance?

If you need assistance with finding roofing insurance, contact the independent insurance agents at Pegram Insurance. Our North Carolina agents are well-versed in these policies, and we’ll make sure you find one that’ll protect your business well.

Working hours

Open | Mon-Fri 9am – 5pm

Closed | Sat-Sun & Holidays

Office

Social profiles

Get in touch!

For questions or insurance quotes, contact us today!