Renters Insurance in North Carolina

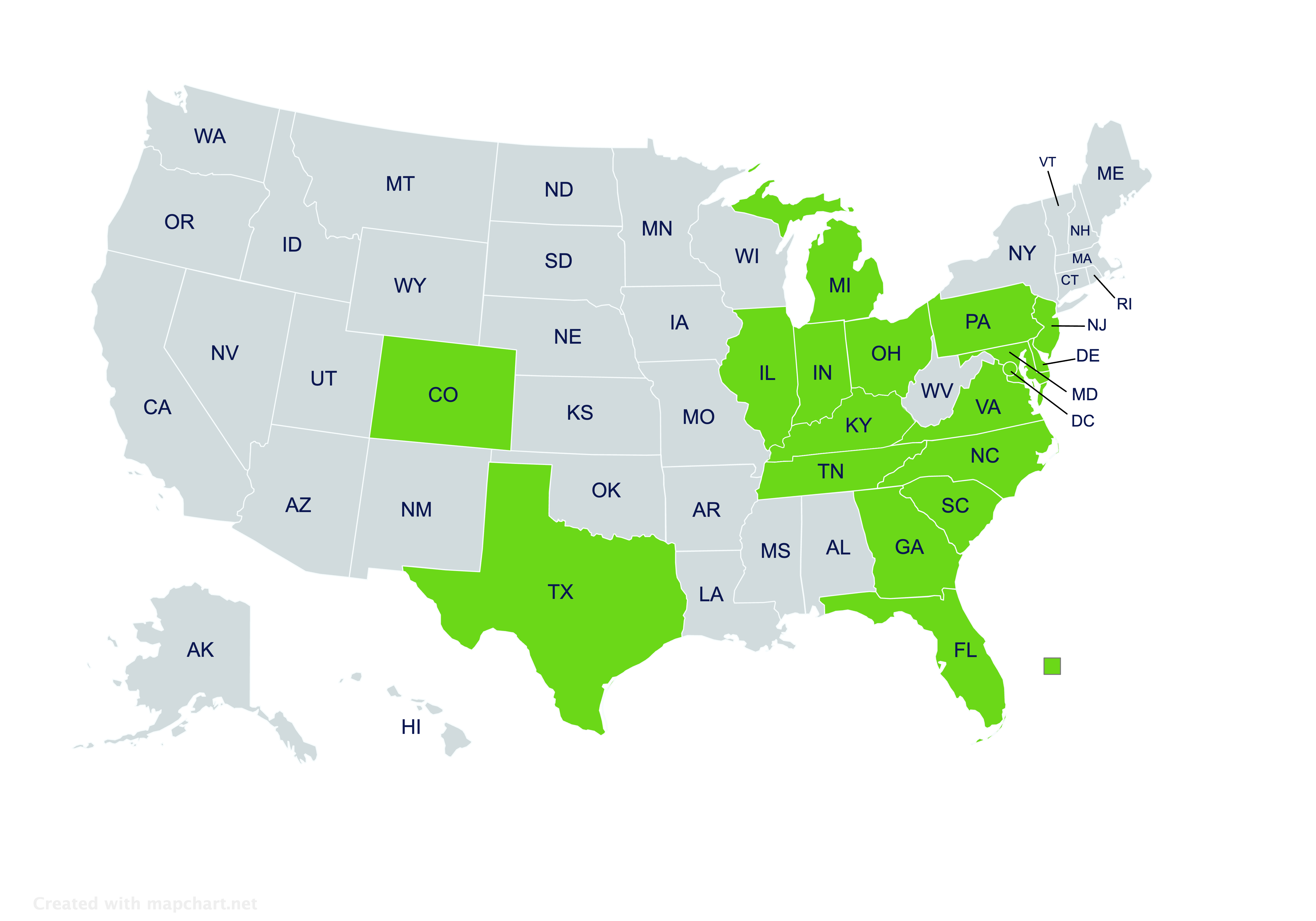

Providing renters insurance solutions to residents in North Carolina and beyond.

Get a Quote

Send us your information for a free quote!

Renters Insurance in North Carolina

What is renters insurance?

Renters may not need to insure their residence against damage like most homeowners do. This doesn’t mean that renters in North Carolina are free of risks, though. From theft to fire, renters insurance might help tenants find protection against a range of risks that they face.

Renters insurance offers important protections for tenants who lease a house, condominium, apartment, or other residence. Policies may protect both renters and their belongings.

Who in North Carolina should have renters policies?

Renters policies are highly under-utilized, with only about 40% of renters purchasing coverage. This is something that almost everyone who rents a place in North Carolina should have.

Moreover, policies aren’t only for those who lease their primary residence. Anyone who signs a lease might want a policy:

- Individuals and families whose primary residence is leased

- Those who lease a coastal or mountain property for the season

- Contractors who lease an apartment while working out of town

- College students who lease an apartment or room during the semester

What coverages do renters policies come with?

Most renters policies come with three main coverages that offer different protections:

- Personal Property Coverage: Normally insures against the loss, damage, or theft of personal belongings such as furniture, electronics, sports equipment, dishes, clothing, and many other items renters own.

- Liability Coverage: Normally insures against lawsuits that might be filed against the renter if someone is injured while visiting, or in another common accident for which the renter is liable. This usually covers certain other personal lawsuits.

- Additional Living Expenses Coverage: Normally insures against unexpected costs for room and board if a residence is destroyed during a covered incident, which could be a fire, severe storm, or other event.

Does renters liability insurance cover dog bites?

Dog owners are generally responsible for any injuries that their dogs inflict. They could be liable for pain, suffering, medical bills, and other costs if their dog severely bites or attacks someone.

Renters liability insurance might cover a dog bite, but it depends on the policy and dog breed. Many policies exclude coverage for certain breeds that are considered aggressive, in which case an optional endorsement or different policy could be needed.

An insurance agent who specializes in renters liability insurance can check which breeds of dogs a particular policy covers. They can then help dog owners find a renters policy that’ll cover a specific breed.

Do college students need a renters policy when away at school?

College students might want a renters policy when away at school. Whether a policy should be purchased depends on where they live at school, and what protections a parent’s homeowners insurance provides.

College students who live at home normally don’t need a renters policy. They likely have liability and property coverage through their parent’s homeowners policy.

Students who live in on-campus dorms probably don’t need a renters policy, but they could in certain situations. They should consider a policy if their parent’s homeowners policy doesn’t have personal property coverage with “worldwide coverage.” So long as a homeowners policy includes worldwide coverage, the student’s possessions are likely protected when at school. Liability coverage is typically still provided by a parent’s homeowners insurance when living on campus.

Students who move off-campus might need a renters policy, especially if they make this their primary residence. A parent’s homeowners insurance is much less likely to extend coverage when leasing a place off campus, potentially leaving students without personal property or personal liability protection unless they get a renters policy.

For help sorting through these details, students and parents can talk with an insurance agent who understands homeowners and renters policies well.

How much do renters pay for insurance?

Renters policies are generally quite affordable, with premiums that can fit into most budgets. To get an exact quote, renters can check policies with an independent agent. Independent agents are able to request customized quotes from multiple insurance companies.

Where can North Carolina renters find renters insurance?

If you’re renting in North Carolina and need insurance, contact the independent insurance agents at Pegram Insurance. Our agents can help you find renters insurance that provides robust protection.

Working hours

Open | Mon-Fri 9am – 5pm

Closed | Sat-Sun & Holidays

Office

Social profiles

Get in touch!

For questions or insurance quotes, contact us today!