Landlord Insurance in North Carolina

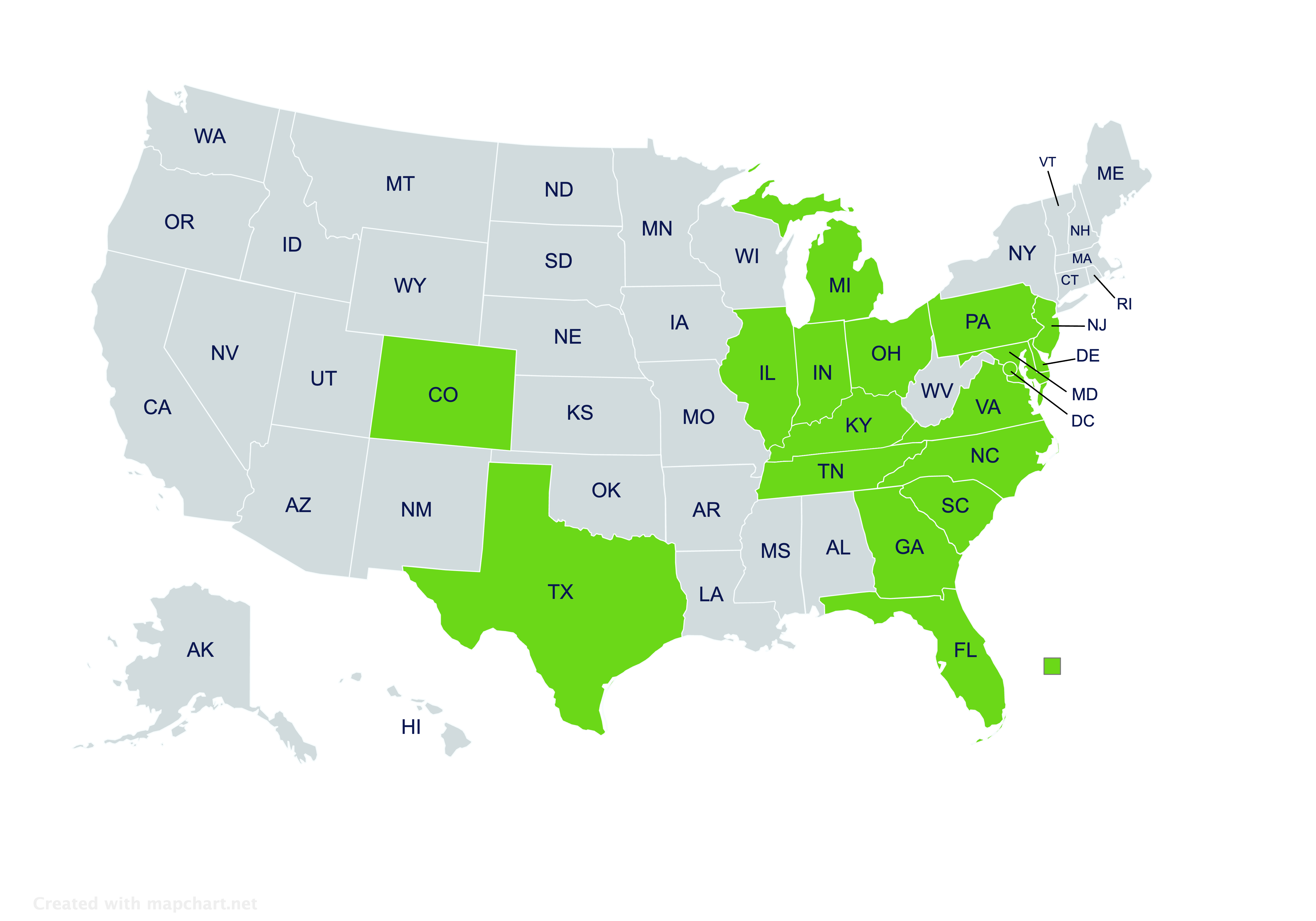

Providing landlord insurance solutions to residents in North Carolina and beyond.

Get a Quote

Send us your information for a free quote!

Landlord Insurance in North Carolina

What is landlord insurance?

Leasing out investment properties comes with certain risks. Accidents can lead to lawsuits, weather can cause damage, and rents might not be paid, just to name a few things that could happen. Landlord insurance may help North Carolina landlords protect themselves from risks such as these.

Landlord insurance can offer residential real estate investors protections for their properties and themselves. Policies typically come with liability, property, and other coverages.

What North Carolina landlords need to have landlord policies?

A landlord policy is something that almost every North Carolina landlord with smaller properties should have. These policies are often used for single-family homes, townhomes, condos, and duplexes.

They might also be used for triplexes and quadplexes. Once a property has five or more units, however, a different insurance policy usually better meets the increased coverage needs.

Are landlord policies suitable for mixed-use properties?

Mixed-use properties often require protections beyond what’s standard in a landlord policy. Landlords who have a small property with both apartments and commercial space should work with a knowledgeable insurance agent.

An agent who understands landlord policies should be able to evaluate other potential options. They might recommend purchasing a different type of policy or amending a landlord policy with additional features.

What coverages can landlord policies come with?

The protections found in any insurance policy can vary, but there are a few that most landlord policies offer. Some of the main coverages found in most of these policies are:

- Property Damage Insurance: Could protect the rental property and other physical items against damage or loss. Protection may include an HVAC system, kitchen and laundry appliances, a lawnmower, and furniture in furnished places.

- General Landlord Liability Insurance: Could protect against lawsuits filed by tenants, or others, who are injured on the property’s premises. May also protect against certain non-personal injury suits.

- Commercial Umbrella Insurance: Could give an additional layer of liability protection against costly lawsuits that exceed the limit of another landlord liability insurance coverage.

- Rent Guarantee Insurance: Could protect against income loss resulting from tenants not paying their rent on time.

- Loss of Rental Income Insurance: Could protect against income loss resulting from disasters that cause major damage such that tenants must move out.

- Legal Assistance Insurance: Could assist with legal expenses not related to liability lawsuits, such as fees incurred if pursuing evictions or judgments.

When does rent guarantee coverage make sense?

Rent guarantee coverage may provide vital financial assistance if tenants fail to pay their rent. This protection might be useful for any landlord, but can be especially important when landlords are dependent upon timely rent payments.

Landlords probably should consider this coverage if they rely on rent for immediate expenses. Lenders frequently require the coverage if a rental property is financed, and coverage would likely be helpful if rent is used to cover personal living expenses.

In situations where rent isn’t needed to pay for immediate expenses, landlords might be able to forgo rent guarantee coverage. For instance, landlords who pay cash for long-term investment properties may not need the coverage if they have another primary income source.

An insurance agent who understands landlord policies will be able to help decide whether this coverage should be included in a policy.

Does homeowners insurance cover lawsuits that a tenant might file?

Most homeowners insurance policies cover certain liability lawsuits under their personal liability coverage. Such protection normally doesn’t extend to suits filed by tenants, however.

For lawsuits that tenants might file, landlord liability insurance is usually needed.

Where can landlords with North Carolina rentals get landlord insurance?

If you have one or more rental properties in North Carolina, let us at Pegram Insurance help you with landlord insurance. One of our independent agents will find a policy that works well for you, offering robust protection at an affordable price.

Working hours

Mon-Fri 9 am -12 pm and 1 pm – 5 pm

By Appointment Only: 12 pm – 1 pm

Office

Social profiles

Get in touch!

For questions or insurance quotes, contact us today!