Airbnb Insurance in North Carolina

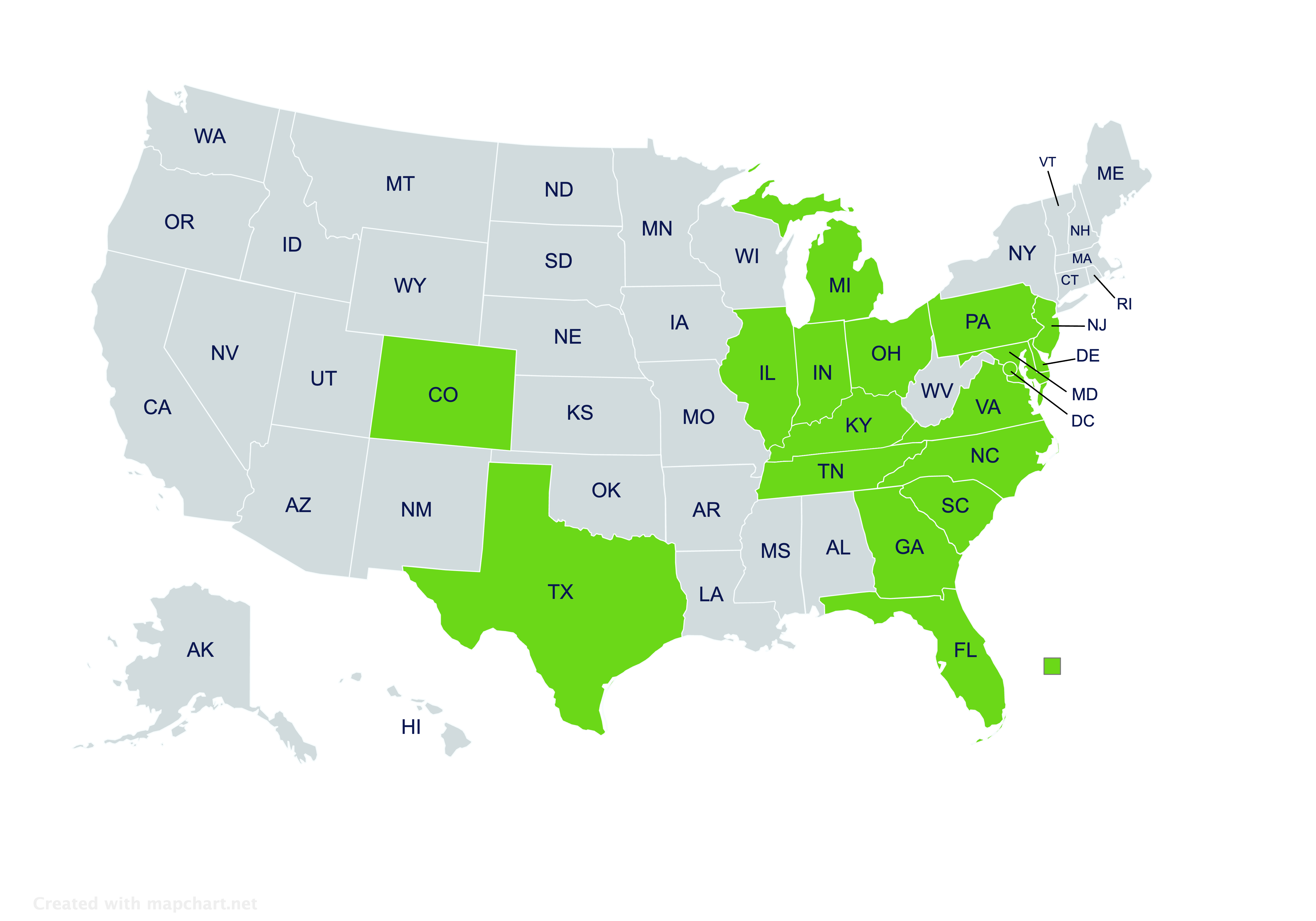

Providing airbnb insurance solutions to residents in North Carolina and beyond.

Get a Quote

Send us your information for a free quote!

Airbnb Insurance in North Carolina

Managing an Airbnb property in North Carolina is an exciting opportunity, but it also comes with unique challenges. At Pegram Insurance Agency, we understand the risks and rewards of hosting short-term rentals. Our goal is to provide you with tailored insurance solutions that help protect your investment while offering peace of mind. Whether you’re renting out a vacation home in the Outer Banks or a cozy cabin in the Blue Ridge Mountains, we’re here to guide you every step of the way.

What is Airbnb Insurance, and why do you need it?

Airbnb insurance is designed to address the specific risks associated with renting out your property on platforms like Airbnb. Standard homeowners insurance policies may not fully cover liabilities or damages arising from short-term rentals. Airbnb insurance bridges this gap by offering coverage for issues such as property damage, liability claims, or unexpected disruptions that can occur during a guest’s stay.

In North Carolina, where Airbnb properties are as diverse as the state itself, from beachside cottages to mountain lodges, having the right coverage ensures you’re prepared for any situation. Whether you’re hosting full-time or occasionally, tailored insurance can help protect both your property and financial security.

Does Homeowner’s Insurance cover Airbnb rentals in North Carolina?

While homeowner’s insurance offers protection for personal residences, it typically excludes business-related activities, including short-term rentals. Renting your property to guests through Airbnb may void certain protections under your existing policy.

For property owners in North Carolina, the key is finding supplemental or specialized insurance that complements your homeowner’s policy. Airbnb insurance can help address gaps by covering risks such as accidental damage caused by guests, personal liability, and loss of income due to unforeseen events. Consulting with an insurance professional ensures you’re not caught off guard by exclusions in your current policy.

What are the risks of hosting an Airbnb in North Carolina?

Hosting an Airbnb in North Carolina comes with a variety of risks that property owners should consider, including:

- Property Damage: Guests may accidentally damage furniture, appliances, or the structure itself.

- Liability Claims: Injuries or accidents occurring on your property can lead to expensive lawsuits.

- Theft: Personal belongings or items within the rental property could be stolen during a guest’s stay.

- Natural Disasters: North Carolina properties, especially those along the coast, are susceptible to hurricanes, flooding, and other natural events that could disrupt rentals.

- Loss of Income: If your property becomes uninhabitable due to damage or a covered incident, you may lose expected rental income.

Airbnb insurance helps mitigate these risks, allowing you to focus on providing a positive experience for your guests.

What Does Airbnb Insurance typically cover?

Airbnb insurance policies vary based on the provider and specific needs of the property owner. While we recommend discussing your options with an experienced agent, typical coverage options may include:

- Property Damage Protection: Coverage for accidental damage to the rental property caused by guests.

- Liability Insurance: Protection against lawsuits or medical expenses arising from injuries or accidents on the property.

- Contents Coverage: Reimbursement for stolen or damaged personal belongings within the rental.

- Loss of Income: Compensation for lost revenue if your property becomes uninhabitable due to a covered event.

- Natural Disaster Coverage: Additional protection for properties in areas prone to hurricanes, flooding, or other natural disasters.

Policies can often be customized to address specific needs, so it’s important to work with an agent who understands North Carolina’s unique risks and regulations.

How is Airbnb Insurance different from Airbnb’s Host Guarantee?

Airbnb offers a Host Guarantee and Host Protection Insurance, but these programs have limitations that may not provide comprehensive coverage. For example:

- Host Guarantee: This program reimburses up to $1 million for damages caused by guests but excludes wear and tear, cash, securities, and certain valuables.

- Host Protection Insurance: Covers liability claims up to $1 million but may not address all types of incidents, such as intentional damage or guest disputes.

Airbnb insurance through Pegram Insurance Agency is designed to complement these programs by filling coverage gaps and offering tailored solutions that specifically address your needs as a North Carolina property owner.

Why choose Pegram Insurance Agency for Airbnb Insurance in North Carolina?

At Pegram Insurance Agency, we pride ourselves on providing personalized insurance solutions to meet the needs of our clients. Here’s what sets us apart:

- Local Expertise: As a North Carolina-based agency, we understand the unique challenges faced by property owners in our state.

- Tailored Coverage Options: We work with you to design policies that address your specific risks and concerns.

- Dedicated Support: Our team is here to answer your questions and assist you in finding the right coverage for your Airbnb property.

- Reputation for Excellence: With years of experience serving North Carolina residents, we’re a trusted name in the insurance industry.

We aim to simplify the insurance process and help you feel confident in your coverage, no matter what comes your way.

What should you consider when choosing Airbnb Insurance?

When selecting Airbnb insurance for your North Carolina property, consider the following factors:

- Location Risks: Properties near the coast or in high-risk areas may require additional coverage for hurricanes, floods, or earthquakes.

- Frequency of Rentals: Full-time rentals may have different coverage needs than properties rented occasionally.

- Type of Property: Vacation homes, condos, and single-family residences each have unique insurance requirements.

- Guest Profile: Larger groups or long-term stays may increase certain risks, such as liability or property damage.

- Policy Limits: Ensure the policy offers sufficient coverage for property value, liability claims, and other risks.

Discussing these factors with a knowledgeable insurance agent can help you find a policy that fits your needs and budget.

How can you get a quote for Airbnb Insurance?

Protecting your Airbnb property in North Carolina has never been easier. At Pegram Insurance Agency, we’re dedicated to helping you find the right insurance solutions to safeguard your investment and support your success as a host.

Contact us today to learn more about our Airbnb insurance options and request a free quote. Let us help you create a worry-free hosting experience for you and your guests.

Working hours

Mon-Fri 9 am -12 pm and 1 pm – 5 pm

By Appointment Only: 12 pm – 1 pm

Office

Social profiles

Get in touch!

For questions or insurance quotes, contact us today!