Non Emergency Medical Transport Insurance in North Carolina

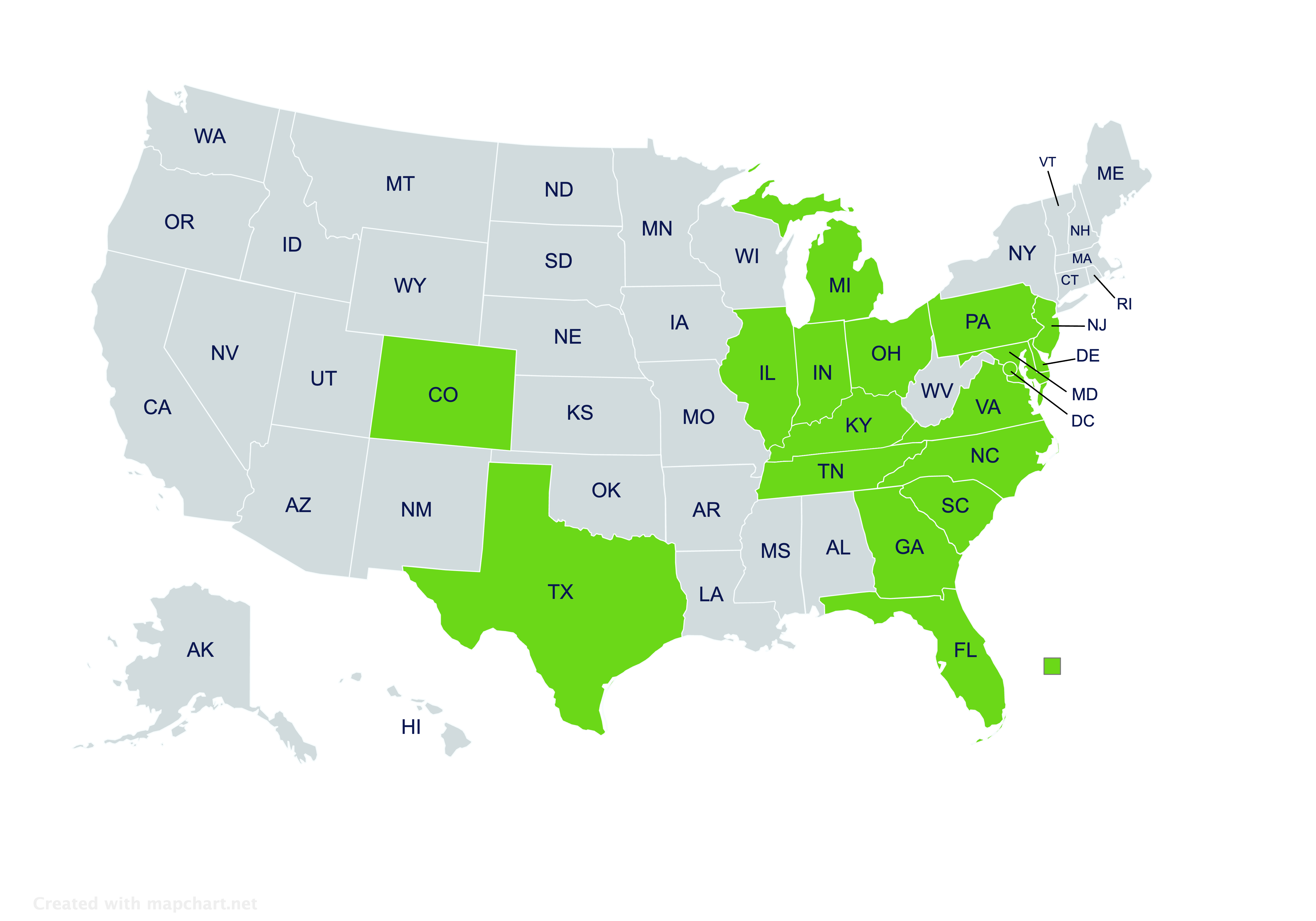

Providing non emergency medical transport insurance solutions to residents in North Carolina and beyond.

Get a Quote

Send us your information for a free quote!

Non Emergency Medical Transport Insurance in North Carolina

What is non-emergency medical transport insurance?

Non-emergency medical transport insurance is a specialized type of insurance designed to cover businesses that provide transportation services for individuals who need medical attention but do not require emergency care. This may include transportation for routine doctor visits, physical therapy sessions, dialysis appointments, and other non-urgent medical needs.

Why is non-emergency medical transport insurance important in North Carolina?

In North Carolina, the demand for non-emergency medical transport (NEMT) services is significant due to the state’s large elderly population and residents with chronic illnesses. Non-emergency medical transport insurance is crucial for these businesses as it helps mitigate the risks associated with transporting vulnerable individuals. This type of insurance ensures that both the business and its clients are protected in the event of accidents, injuries, or other unforeseen incidents during transportation.

What does non-emergency medical transport insurance cover?

Non-emergency medical transport insurance typically covers a variety of risks, including:

- Liability Coverage: Protects against claims of bodily injury or property damage caused by the transport service. This is essential for covering legal fees and compensation costs if a third party is injured or their property is damaged during transport.

- Auto Liability: Covers accidents involving the transport vehicles. This includes not only the cost of repairs for your own vehicle but also damages to other vehicles and property involved in the accident.

- Professional Liability: Protects against claims of negligence or errors in providing transport services. For example, if a client claims they were injured due to improper handling during transport, this coverage may help cover legal costs and settlements.

- Workers’ Compensation: Covers medical expenses and lost wages for employees injured on the job. Physical Damage: Covers repairs or replacement of the transport vehicles in case of damage or theft. This helps maintain your fleet’s operation without significant financial setbacks.

- Medical Payments: Covers medical expenses for injuries sustained by passengers during transport.

- Uninsured/Underinsured Motorist Coverage: Protects your business in the event that one of your vehicles is involved in an accident with a driver who lacks sufficient insurance coverage. This may cover medical costs and vehicle repairs when the other party is unable to pay.

- Equipment Breakdown Coverage: Covers the cost of repairing or replacing essential equipment that breaks down. This may include medical equipment used during transport, ensuring that service interruptions are minimized.

- General Liability: Extends beyond auto liability to cover incidents that occur outside of vehicle operation, such as slip and fall accidents at your facility. This broadens the scope of protection for your business.

Who needs non-emergency medical transport insurance?

Non-emergency medical transport insurance in North Carolina is typically needed by:

- Non-Emergency Medical Transport Companies: Businesses that provide transportation services for patients who need to attend medical appointments or receive routine medical care but do not require emergency services. This includes companies that transport patients to and from dialysis centers, physical therapy appointments, or routine medical check-ups.

- Ambulette Services: Companies that offer specialized transportation for individuals with medical conditions who need assistance but are not in an emergency situation. This includes transport for patients who use wheelchairs or other mobility aids.

- Medical Transportation Providers: Organizations that handle scheduled medical transport, including those providing services to the elderly or disabled, who need regular medical treatments or therapies.

- Healthcare Facilities: Some healthcare facilities may need non-emergency medical transport insurance if they operate their own transport services for patients who need to be transported for scheduled procedures or follow-up appointments.

- Drivers or Independent Contractors: Individuals who operate non-emergency medical transport services on a freelance or contractual basis may need their own insurance to cover the risks associated with providing these services.

This insurance helps protect against potential liabilities and provides coverage for issues such as vehicle accidents, property damage, and injury claims related to the transportation of non-emergency patients.

What factors affect the cost of non-emergency medical transport insurance?

Several factors may influence the cost of non-emergency medical transport insurance in North Carolina:

- Fleet Size: The number of vehicles you operate will impact your insurance premiums.

- Vehicle Type: The make, model, and age of your vehicles may affect the cost of coverage.

- Driving Records: The driving history of your employees may influence your insurance rates.

- Coverage Limits: Higher coverage limits typically result in higher premiums.

- Location: Where your business operates within North Carolina may affect the cost due to varying risks in different areas.

- Claims History: A history of claims may lead to higher premiums as it indicates higher risk.

What are the common claims in non-emergency medical transport insurance?

Common claims in non-emergency medical transport insurance include:

- Auto Accidents: Claims related to vehicle collisions or accidents.

- Passenger Injuries: Claims for injuries sustained by passengers during transport.

- Property Damage: Claims for damage to third-party property caused by your vehicles.

- Employee Injuries: Claims for injuries to employees while performing their duties.

- Professional Liability: Claims alleging negligence or errors in providing transport services.

What are the risks of not having non-emergency medical transport insurance?

Operating without non-emergency medical transport insurance in North Carolina may expose your business to several risks, including:

- Financial Loss: Paying out-of-pocket for damages, medical expenses, and legal fees may be financially devastating.

- Legal Consequences: Failure to comply with state insurance requirements may result in fines, penalties, or the loss of your operating license.

- Reputation Damage: Incidents without adequate coverage may harm your business’s reputation and lead to loss of trust among clients.

- Operational Disruptions: Uninsured incidents may disrupt your operations and negatively impact your business’s ability to serve clients.

How can North Carolina organizations and businesses obtain non-emergency medical transport insurance?

Reach out to the independent agents at Pegram Insurance Agency for a fast quote on non-emergency medical transport insurance in North Carolina. Our knowledgeable team is dedicated to helping you find the right coverage tailored to your business needs. We understand the unique challenges of the non-emergency medical transport industry and are here to provide expert guidance and support. With our competitive rates and comprehensive insurance solutions, you may ensure the safety and security of your business and clients.

Working hours

Mon-Fri 9 am -12 pm and 1 pm – 5 pm

By Appointment Only: 12 pm – 1 pm

Office

Social profiles

Get in touch!

For questions or insurance quotes, contact us today!