Contractors Insurance in North Carolina

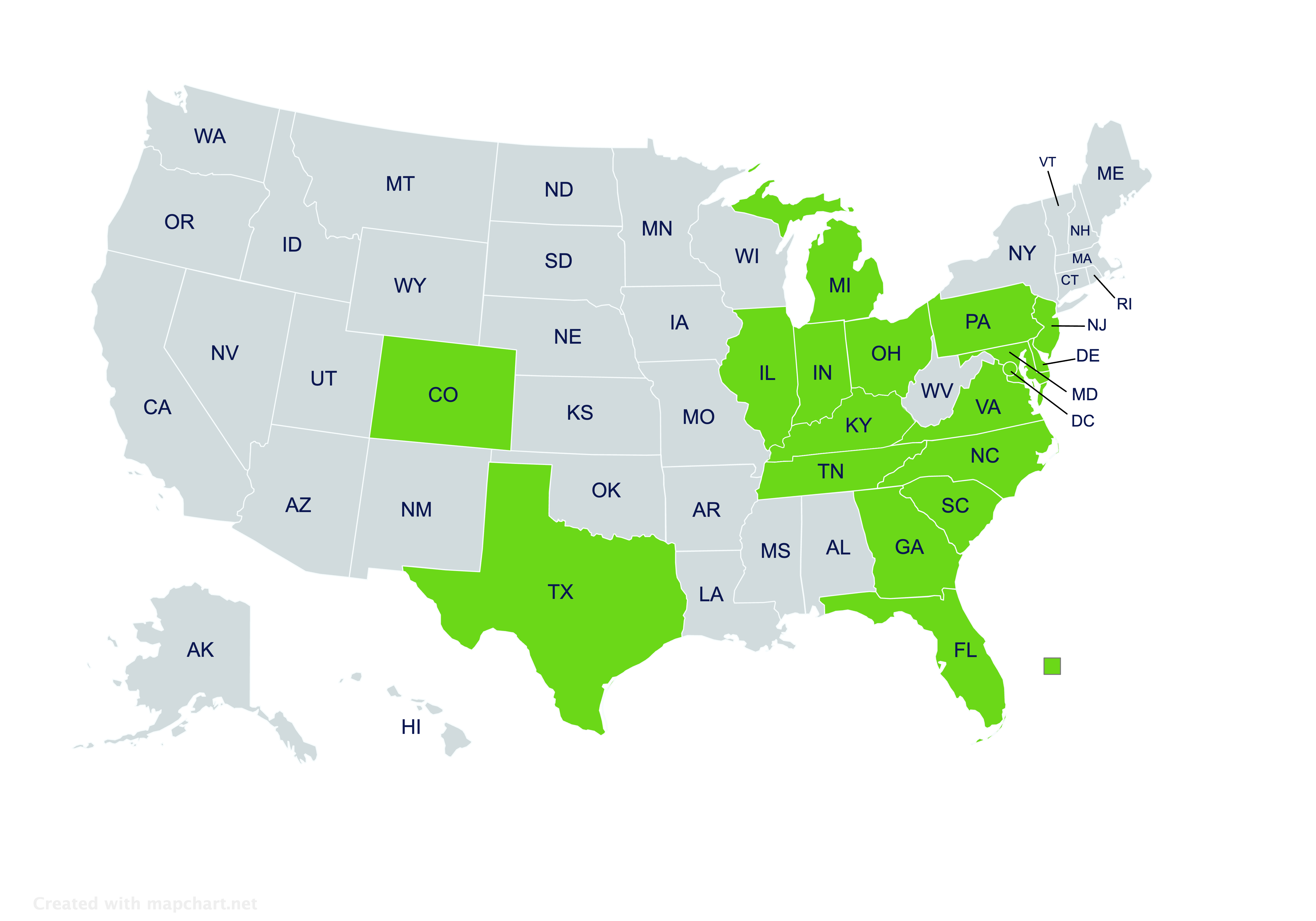

Providing contractors insurance solutions to residents in North Carolina and beyond.

Get a Quote

Send us your information for a free quote!

Contractors Insurance in North Carolina

At Pegram Insurance Agency, we understand the unique needs of contractors in North Carolina. Whether you’re a general contractor, subcontractor, or specialized trade professional, our team is dedicated to providing you with tailored insurance solutions designed to protect your business and help it thrive. Learn more about our offerings and discover how we can help safeguard your business.

What is Contractors Insurance?

Contractors insurance is a type of business insurance specifically designed to provide coverage for contractors and construction businesses. It helps protect against various risks contractors face on job sites, in the office, and even when working off-site. With the complexities and potential hazards involved in construction projects, contractors insurance can be an essential tool in ensuring business continuity, managing risks, and maintaining financial stability.

At Pegram Insurance Agency, we offer a range of contractors insurance policies to ensure your business is protected from unexpected situations. These policies often include general liability, workers’ compensation, property insurance, and more. The goal is to help you find the right combination of coverage that aligns with your business operations and risk exposure.

Why Do North Carolina Contractors Need Specialized Insurance?

North Carolina contractors face distinct challenges in their industry. From unpredictable weather to varying building codes and regulations across counties, it’s important to have an insurance policy that’s tailored to the specific needs of your business. Whether you’re working in Raleigh, Charlotte, or a smaller town in the state, local regulations and risks can differ, and so should your insurance.

With Pegram Insurance Agency, we help North Carolina contractors navigate these complexities by offering personalized insurance solutions. Our local expertise means we understand how local risks and regulations impact your work, giving you peace of mind knowing you’re covered wherever your projects take you. We work with you to customize your policy to fit the exact nature of your business, ensuring you are protected no matter the job.

What Types of Contractors Insurance Should North Carolina Contractors Consider?

There are many different types of coverage available to contractors, and what you need will depend on your specific line of work. In general, contractors in North Carolina may want to consider the following types of coverage:

- General Liability Insurance: This type of coverage is essential for most contractors. It can help protect your business from claims of bodily injury, property damage, and other accidents that may occur during a project.

- Workers’ Compensation Insurance: Contractors with employees are often required by North Carolina law to have workers’ compensation coverage. This insurance helps cover medical expenses and lost wages for workers injured on the job.

- Commercial Auto Insurance: If your business involves driving vehicles, you’ll need commercial auto insurance to cover any accidents, theft, or damages related to your company vehicles.

- Professional Liability Insurance: Contractors who provide advice or design services may want to consider this coverage. It can protect against claims of negligence, errors, or omissions in your professional services.

- Property Insurance: If you own tools, equipment, or a business property, property insurance can help protect these assets from damage or loss.

Pegram Insurance Agency offers a variety of contractors insurance policies that you can combine to create a comprehensive coverage package that best suits your needs.

How Does Pegram Insurance Agency Help North Carolina Contractors with Insurance?

At Pegram Insurance Agency, we specialize in helping contractors in North Carolina navigate the world of insurance. Our approach is customer-focused, and we pride ourselves on offering expert advice and personalized service. Here’s how we support contractors like you:

- Understanding Your Business Needs: We take the time to understand your business operations, the scope of your projects, and the risks you face. This allows us to recommend coverage options that align with your needs.

- Customized Coverage Plans: Instead of offering one-size-fits-all solutions, we tailor your insurance policy to fit the unique demands of your business. Whether you’re working on residential projects, large commercial builds, or specialty trades, we’ll create a policy that provides optimal protection.

- Experienced Agents: Our team has years of experience working with contractors throughout North Carolina. We know the risks, challenges, and opportunities you face, and we’re here to guide you every step of the way.

- Local Expertise: We understand North Carolina’s building codes, industry regulations, and specific challenges. This local expertise ensures that you have the right coverage in place, whether you’re working in the heart of Charlotte or a rural area.

- Ongoing Support: Insurance isn’t just about signing up for a policy—it’s about building a lasting relationship. We’re here to provide ongoing support and assist you with any questions or claims that may arise throughout the life of your policy.

How Can Pegram Insurance Agency Help Contractors Save Money on Insurance?

As a contractor, you’re always looking for ways to reduce costs without sacrificing quality. Pegram Insurance Agency can help you save money by working with you to create a customized insurance package that fits your business’s needs without overpaying for unnecessary coverage. Here are a few ways we help you manage costs:

- Bundling Coverage: By combining different types of coverage, such as general liability, workers’ compensation, and commercial auto insurance, you may qualify for discounts. Bundling policies can help lower your overall premiums.

- Risk Management Advice: We provide proactive advice on risk management practices that can help reduce the likelihood of accidents and claims. By taking steps to improve workplace safety, you may be able to lower your insurance costs.

- Claims History Review: A clean claims history can lead to better rates. We’ll work with you to minimize claims and ensure you get the best value for your policy.

- Adjusting Coverage as Your Business Grows: As your business evolves, your insurance needs may change. We’ll help you adjust your coverage as your business expands, ensuring you’re only paying for the coverage you need.

How Do I Get Started with Contractors Insurance in North Carolina?

Getting started with contractors insurance at Pegram Insurance Agency is easy! Whether you’re new to the industry or looking to update your existing policy, our team is here to help every step of the way. Here’s how you can get started:

- Contact Us: Reach out to us via phone, email, or our website. We’ll schedule a consultation to discuss your business’s needs and determine the best coverage options.

- Assess Your Needs: We’ll ask questions about your business, the type of work you do, the number of employees you have, and the risks you face on the job.

- Get a Customized Quote: Based on your needs, we’ll provide you with a customized quote. We’ll take the time to explain your options so you can make an informed decision.

- Secure Your Coverage: Once you’ve selected your coverage, we’ll help you complete the necessary paperwork and get your policy in place.

- Ongoing Support: After your policy is in place, we continue to be a resource for you. We’ll check in periodically to make sure your coverage stays up-to-date and make adjustments as your business grows.

Why Choose Pegram Insurance Agency for Your Contractors’ Insurance Needs in North Carolina?

Choosing the right insurance provider is an important decision, and Pegram Insurance Agency stands out for several reasons:

- Personalized Service: We’re committed to offering personalized solutions and building long-term relationships with our clients.

- Expertise and Knowledge: With years of experience in the insurance industry, we specialize in the needs of North Carolina contractors.

- Trusted Partner: We’re not just an insurance agency—we’re a partner in your business success. We help you protect what matters most.

Contact Pegram Insurance Agency today to learn more about contractors insurance and how we can help safeguard your North Carolina business. Whether you’re working on a small renovation or a large construction project, we’ve got you covered!

Working hours

Mon-Fri 9 am -12 pm and 1 pm – 5 pm

By Appointment Only: 12 pm – 1 pm

Office

Social profiles

Get in touch!

For questions or insurance quotes, contact us today!