House Cleaning Insurance in North Carolina

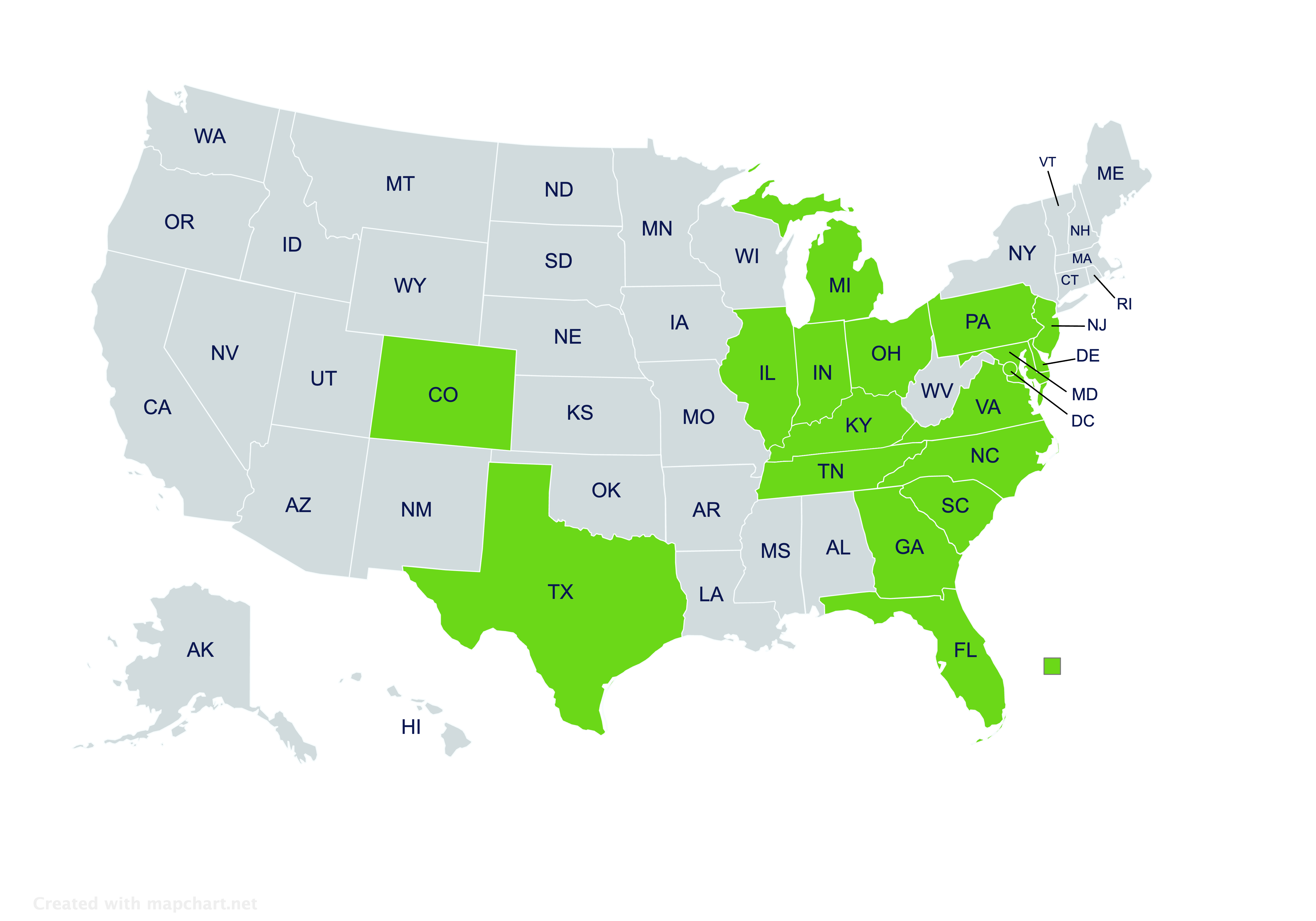

Providing house cleaning insurance solutions to residents in North Carolina and beyond.

Get a Quote

Send us your information for a free quote!

House Cleaning Insurance in North Carolina

What is house cleaning insurance?

House cleaning insurance is a type of business insurance designed to protect cleaning service providers from financial losses due to accidents, damages, or lawsuits that may occur during the course of their work. It helps cover risks such as property damage, bodily injury, or legal claims arising from cleaning activities. This insurance ensures that cleaning businesses can continue operating without bearing the full financial burden of unexpected events or incidents that may occur while providing their services.

What types of coverage are included in house cleaning insurance?

House cleaning insurance in North Carolina typically includes:

- Property Damage Insurance – Property damage insurance covers damage to or loss of your cleaning equipment, supplies, and business property.

- Workers’ Compensation Insurance – In North Carolina, if you have employees, you are required to carry workers’ compensation insurance. This coverage provides financial support for employees who are injured while working. It covers:

- Bonding Insurance – A bonding insurance policy helps protect your clients from theft or dishonesty on the part of your employees.

- Commercial Auto Insurance – If your cleaning business involves using a vehicle to transport equipment, employees, or supplies, commercial auto insurance is essential. This coverage protects against accidents, theft, or damage to your vehicle while it’s being used for business purposes.

- Business Interruption Insurance – Business interruption insurance helps cover lost income if your cleaning business is unable to operate due to a covered event. This could include damage to your equipment, an accident that prevents you from working, or other unforeseen circumstances.

Does house cleaning insurance cover services provided by subcontractors?

In most cases, house cleaning insurance can cover services provided by subcontractors, but this depends on the terms of your specific policy. Some insurance policies include subcontractors as part of the business operations, while others may require additional coverage or an endorsement for subcontracted work. If your subcontractors are performing cleaning services on your behalf, it’s important to verify with your insurance provider whether they are covered under your general liability or workers’ compensation insurance. If subcontractors are not automatically included, you may need to add them to your policy or purchase separate insurance to cover their work. Always discuss the details of subcontractor coverage with your insurer to ensure your business remains fully protected.

Does house cleaning insurance provide coverage for my personal vehicle when used for business purposes?

Standard house cleaning insurance policies typically do not cover personal vehicles used for business purposes. To ensure your personal vehicle is protected when you’re using it for cleaning-related tasks (such as transporting cleaning equipment or supplies), you would need commercial auto insurance. This type of coverage can be added to your policy or purchased separately. Without commercial auto insurance, your personal auto insurance policy may not cover accidents or damages that occur while you’re using your vehicle for business purposes. It’s important to clarify this with your insurance provider, as driving your personal vehicle for work-related tasks can expose you to additional risks that require specific coverage.

Can I get house cleaning insurance if I only operate part-time?

Yes, you can get house cleaning insurance even if you operate part-time. Many insurance providers offer flexible policies tailored to the needs of small or part-time cleaning businesses. If you’re operating on a part-time basis, you may be able to adjust your coverage limits or premium to fit your schedule and budget. You can opt for general liability insurance to cover potential risks, or workers’ compensation if you have employees, and even specialized coverage for any equipment you use. Insurance providers understand that part-time businesses may have different needs than full-time operations, so they typically offer scalable options that allow you to pay only for the coverage you need.

What are the factors affecting the cost of house cleaning insurance?

The cost of house cleaning insurance in North Carolina can vary based on several factors, including:

- Business Size and Scope – The size of your cleaning business and the number of employees can affect the premium. Larger businesses with more staff typically pay higher premiums due to increased risk.

- Type of Coverage – The specific coverages you choose (e.g., general liability, workers’ compensation, property insurance) will influence the cost. More comprehensive policies or additional coverage types generally lead to higher premiums.

- Location – The location of your business impacts the cost due to local risks, such as crime rates, natural disasters, and the cost of medical care (which affects workers’ compensation).

- Claims History – A history of frequent or severe claims can raise premiums, as insurers view businesses with higher claims risk as more costly to insure.

- Employee Training and Experience – Businesses with well-trained, experienced staff may receive lower premiums, as they are seen as less likely to cause accidents or damage.

- Revenue and Business Volume – Higher annual revenue or a larger number of clients could mean a higher premium due to the increased exposure to risk.

- Deductibles and Policy Limits – The higher the deductible or the lower the coverage limits, the lower the premium. However, this means you will pay more out-of-pocket in the event of a claim.

- Type of Cleaning Services – Specialized services, such as cleaning high-risk areas (e.g., construction sites, hazardous materials), may increase the cost of insurance due to the added risk.

How can North Carolina professional cleaners obtain house cleaning insurance?

Reach out to the independent agents at Pegram Insurance Agency for a fast quote on house cleaning insurance in North Carolina. Our experienced team is here to help you find the right coverage that fits your unique business needs, whether you’re a solo entrepreneur or managing a growing team. Don’t leave your business exposed—contact Pegram Insurance today to secure the protection you need and gain peace of mind as you focus on delivering top-notch cleaning services.

Working hours

Mon-Fri 9 am -12 pm and 1 pm – 5 pm

By Appointment Only: 12 pm – 1 pm

Office

Social profiles

Get in touch!

For questions or insurance quotes, contact us today!