Electrician Insurance in North Carolina

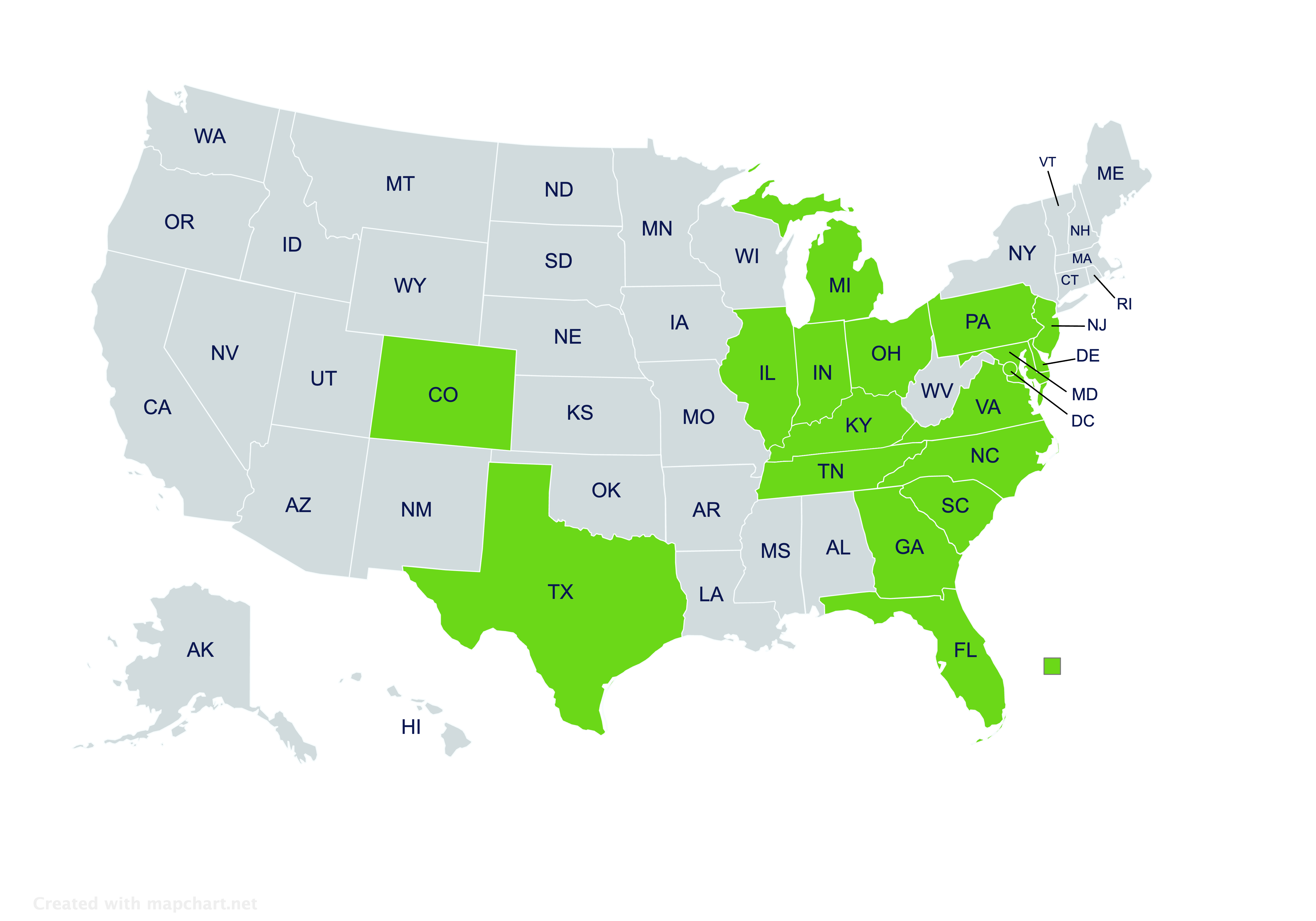

Providing electrician insurance solutions to residents in North Carolina and beyond.

Get a Quote

Send us your information for a free quote!

Electrician Insurance in North Carolina

What is electrician insurance?

Electrician insurance is a specialized type of coverage designed to protect electrical contractors and their businesses from various risks and liabilities associated with their work. As an electrician, you are exposed to unique hazards that may result in costly claims or lawsuits. Electrician insurance provides financial protection against these risks, helping you avoid significant out-of-pocket expenses.

Why do electricians in North Carolina need insurance?

Electricians in North Carolina need insurance to protect themselves from the numerous risks associated with their trade. Whether you’re working on residential, commercial, or industrial projects, accidents may happen. These accidents may lead to property damage, injuries, or even legal disputes, all of which may be financially devastating without the right insurance coverage.

Here are some key reasons why electricians in North Carolina need insurance:

- Compliance with state regulations: North Carolina requires electricians to carry certain types of insurance, such as workers’ compensation, to operate legally.

- Protection against lawsuits: If a client or third party claims that your work caused injury or property damage, electrician insurance may cover legal fees and settlements.

- Financial security: Insurance helps cover the costs of accidents, damages, or losses that could otherwise jeopardize your business.

- Professional credibility: Clients are more likely to trust and hire electricians who carry adequate insurance coverage, as it demonstrates professionalism and responsibility.

What type of businesses need electrician insurance?

Electrician insurance in North Carolina is essential for a variety of professionals and businesses involved in electrical work to protect against potential risks and liabilities. Those who typically need electrician insurance include:

- Licensed Electricians: Individual electricians who work independently or are self-employed need insurance to cover potential liabilities, such as property damage or injuries that could occur while performing electrical work.

- Electrical Contractors: Companies or businesses that provide electrical services to residential, commercial, or industrial clients need insurance to protect against claims of property damage, bodily injury, or professional errors and omissions.

- Electrical Apprentices and Trainees: While often covered under their employer’s insurance policy, apprentices and trainees may also need separate coverage, especially if they are working independently or on freelance projects.

- Subcontractors: Electricians who work as subcontractors for larger companies or general contractors should have their own insurance to ensure they are protected if a claim arises from their work.

- Businesses Employing Electricians: Companies that employ electricians as part of their staff, such as construction firms, maintenance services, and manufacturing companies, need insurance to cover their employees while they perform electrical work.

What does electrician insurance cover?

Electrician insurance in North Carolina typically includes several types of coverage to protect against various risks. The most common types of coverage are:

- General liability insurance: This covers third-party claims for bodily injury, property damage, and advertising injury. For example, if you accidentally damage a client’s property while working, general liability insurance may cover the repair costs.

- Workers’ compensation insurance: This is required by law in North Carolina for businesses with three or more employees. Workers’ compensation insurance covers medical expenses and lost wages for employees who are injured on the job.

- Commercial auto insurance: If you use a vehicle for your electrical business, commercial auto insurance is essential. It covers accidents, property damage, and injuries that occur while driving for work-related purposes.

- Professional liability insurance: Also known as errors and omissions (E&O) insurance, this covers claims of negligence, mistakes, or incomplete work that result in financial loss for a client.

- Tools and equipment coverage: This optional coverage protects your tools and equipment against theft, loss, or damage, whether they’re on the job site, in transit, or stored at your business location.

- Commercial property insurance: If you own or lease a physical location for your business, commercial property insurance covers the building and its contents against risks like fire, theft, and natural disasters.

What factors affect the cost of electrician insurance?

The cost of electrician insurance in North Carolina varies based on several factors. On average, electricians may expect to pay between $500 and $2,000 per year for general liability insurance alone. However, adding other types of coverage, such as workers’ compensation or commercial auto insurance, will increase the total cost.

Here are some factors that influence the cost of electrician insurance in North Carolina:

- Business size: Larger businesses with more employees or higher revenue may pay more for insurance due to the increased risk.

- Coverage limits: Higher coverage limits provide more protection but also result in higher premiums.

- Location: Insurance costs may vary based on your location within North Carolina, as some areas may have higher risks of certain claims.

- Claims history: A history of frequent or severe claims may lead to higher premiums, as insurers view your business as higher risk.

- Type of work: Electricians who work on high-risk projects, such as industrial or large-scale commercial jobs, may pay more for insurance compared to those who focus on residential work.

What are the legal requirements for electrician insurance in North Carolina?

In North Carolina, electricians are required to carry certain types of insurance to comply with state laws and regulations. The primary legal requirements include:

- Workers’ compensation insurance: If you have three or more employees, you are required to carry workers’ compensation insurance. This coverage provides benefits to employees who are injured on the job, including medical expenses and lost wages.

- Commercial auto insurance: If you use a vehicle for business purposes, you must have commercial auto insurance. This coverage is required by law in North Carolina and provides protection in case of accidents, injuries, or property damage involving your work vehicle.

Do electrical businesses need workers compensation insurance?

Workers’ compensation insurance is a crucial component of electrician insurance in North Carolina. It provides benefits to employees who are injured or become ill due to their work. Here’s how it works:

- Coverage for medical expenses: Workers’ compensation insurance covers the cost of medical treatment for work-related injuries or illnesses. This includes doctor visits, hospital stays, surgeries, medications, and rehabilitation.

- Lost wages: If an employee is unable to work due to a work-related injury or illness, workers’ compensation insurance provides a portion of their lost wages during their recovery period.

- Disability benefits: Workers’ compensation insurance also provides disability benefits if an employee is permanently or temporarily disabled due to a work-related injury or illness. These benefits help compensate for the loss of earning capacity.

- Death benefits: In the unfortunate event that an employee dies as a result of a work-related injury or illness, workers’ compensation insurance provides death benefits to the employee’s dependents, including funeral expenses and financial support.

How can North Carolina electricians obtain electrician insurance?

Reach out to the independent agents at Pegram Insurance Agency for a fast quote on electrician insurance in North Carolina. With our expertise in tailoring coverage to meet the unique needs of electricians, we can provide comprehensive protection at competitive rates. Whether you’re just starting your business or looking to review and update your current policies, Pegram Insurance Agency is committed to helping you secure the right coverage to keep your business safe and compliant.

Working hours

Open | Mon-Fri 9am – 5pm

Closed | Sat-Sun & Holidays

Office

Social profiles

Get in touch!

For questions or insurance quotes, contact us today!